XTB offers forex trading with very low spreads from 0.1 pips. You can trade 24/5.

| GBP/USD Spread | 0.1 pips |

| EUR/GBP Spread | 0.1 pips |

| EUR/USD Spread | 0.2 pips |

| Assets | 48+ |

| S&P500 CFD | 0.6 average |

| Europe 50 CFD | 0.6 average |

| Stocks Spread | Variable |

| Oil Spread | Variable |

XTB offers a wide range of crypto markets with very competitive spreads. You can choose from 9 individual coins or 16 Crypto pairs.

| BTC min. Spread | 1% |

| ETH min. Spread | 2% |

| Leverage | Yes |

| Cryptocurrencies | 9 |

XTB is a global multi-asset forex and CFD broker. The company has headquarters in Warsaw and London. XTB is a trusted broker for competitive products and services. The broker offers an excellent experience through the xStation 5 trading platform and good overall customer service. XTB provides clients with access to a selection of different markets including shares, metals, cryptocurrencies, forex, indices and commodities.

The goal of XTB is the creation of long-term relationships with customers by providing all of the tools required for successful trading. XTB is currently operating in 17 different regions and countries with a separate version for international clients. Each version differs slightly in leverage, funding methods, spreads, account types and various intricacies. The majority of results for this XTB review are favorable.

Contents

Account Opening

The process of opening an account with XTB is simple, straightforward and completely digital. Trading is available during the same day the account is opened. The minimum deposit required is dependent on the country. Some European countries do not have a minimum deposit, while the minimum within the United Kingdom is $250. Customer service will provide the minimum deposit required for the country of each client prior to opening an account. The different types of account available are:

- Standard Accounts: A standard account offers access to more than 1,500 instruments such as ETF CFDs, stock CFDs, forex, cryptocurrency, commodities and indices. A standard account offers maximum leverage of 1:200, market execution, minimum orders of 0.1 and the minimum spread is 0.35. The account includes automated trading and negative balance protection. There is no charge for management or setup with a standard account. Both xStation and MT4 are available.

- Pro Accounts: The asset access for Pro accounts is exactly the same as for a standard account. The maximum leverage is 1:200 with a 0.28 minimum spread. The set up is free with no management fees. Both xStation and MT4 are available.

- Islamic Accounts: An Islamic account is a lot like a standard account. The difference is the account is swap-free with no cryptocurrency trading available.

The only accounts available to users in the United Kingdom are the standard and pro versions. Both offer floating spreads with market execution available with the Pro version. To reach market levels, the user pays a small commission. The standard account spreads for the United Kingdom float with the minimum at 0.9 pips. The minimum spread for the Pro version is 0 pips. To open an account, the user must take the following steps.

- Provide country of residency and valid email address

- Choose account base currency, account type and the trading platform

- Answer questions about trading experience, financial status and employment status

- Verify identity and residency to activate the account

Some of the European clients are able to verify their identity through a video. When this type of verification is not possible, the user has to verify their identity by uploading a scanned copy or photo of their driver’s license, passport or photo ID. The acceptable proof of residency documents includes bank statements and utility bills.

Demo Account

Commissions and Fees

According to the information found for this XTB review, the fees and trading conditions are different for Pro and Standard accounts. The standard account offered by XTB is for residents of Ireland and the United Kingdom only. The Pro account is based on commissions. There are a different spread model and execution method for every account regarding fees and commissions. Most of the spreads are competitive. Traders can use the MT4 or xStation 5 platform with both accounts.

The target spreads are listed by XTB on the EUR/USD for the different types of accounts. The basic account includes two pips, the MT4 0.9 pips and the standard account 0.7 pips. For 2019, the majority of clients selected the standard account. The average spread for the EUR/USD pair offered by XTB during the third quarter of 2019 was 0.78 pips. XTB minimum deposits for both standard and Pro versions start at a base currency of $250.

The most competitive option for lower spreads is the Pro account. Depending on the currency used by the account, the commission per side is $4, €3.5 or £2.5 for 100k (standard lots). Active traders including users in the EU meeting the requirements for an elective professional receive a rebate from XTB for a portion of the spread. When the user reaches specific volume thresholds, the rebate is between 10 and 30 percent.

There are five active discount tiers for traders linked to volume. The tiers begin with more than 50 lots every month. The highest level is over 1000 for monthly volume requirements. The active trader program is referred to as the XTB lower spread group. The group helps the broker compete with competitors including FOREX.com and FXCM with CMC Markets liquidity rebates or offerings for active traders.

The standard account offers no commission for forex, commodities, indices and cryptocurrency. The minimum spread is 0.35 pips with maximum leverage at 1:30. The commission per lot for stock CFDs and EFTs is 0.8 percent. The minimum spread for a Pro account is 0.28 pips with maximum leverage at 1:30. The commission per lot for stock CFDs and EFTs is 0.8 percent.

The XTB fees for Islamic accounts through the Arabic subdivision are as follows. The Islamic account does not offer any swaps.

- CFD: The FTSE spread is 0.08 percent, the oil spread is 0.03, the GBP/USD spread is 0.01 and the stock spread is 0.2.

- Forex: The GBP/USD spread is 0.01, EUR/GBP 0.1 and EUR/USD 0.2.

A variety of loyalty rewards are offered by XTB. The cashback transfers are in accordance with lower spread groups and trading amounts. The private WhatsApp group offers a different loyalty reward of notifications sent in real-time from the XTB trading team. A $1,000 non-EU bonus is offered for referrals. The most loyal clients are offered programs for one-on-one mentorship. All of these programs are conducted by the XTB team on a regular basis.

| Description | XTB |

|---|---|

| Account fee | No |

| Deposit fee | $0 |

| Withdrawal fee | $0 |

| Inactivity fee | No |

Deposit and Withdrawal

XTB withdrawals and deposits are fast and available using several different forms. The selection of account base currency offered by XTB also receives a favorable XTB review. All of the major currencies are covered including EUR, USD and GBP. There are some minor currencies also available. If the same currency used for funding the account is used for trading assets, the conversion fee is eliminated.

The best option for saving on fees for converting currency is to open a digital bank, multi-currency account. There are several options available offering different currencies for bank accounts with cheap or free international bank transfers and good exchange rates for currency. An account can be opened by phone in just a couple of minutes.

There are no deposit fees charged by XTB. Some of the electronic wallets charge high deposits fees. The fee for Skrill and PayPal is two percent of the amount deposited. The available deposit options are dependent on the location of the user and include:

| Deposit & Withdrawal Method | Available |

|---|---|

| VISA / Mastercard / Maestro |  |

| Credit/Debit Cards |  |

| Paypal |  |

| Bank Transfer |  |

| Skrill |  |

Several business days may be required for a bank transfer. Electronic wallets and debit or credit cards are instant. Funds can only be deposited from sources in the name of the user. If the amount of withdrawal is a minimum of $100, there are no fees from XTB. Bank transfers are the only acceptable method for withdrawals. If the withdrawal is less than $100, a high fee will be charged by XTB.

The fee for withdrawals less than $100 is $20, £60 is £12 and €80 is €16. The average length of time necessary for a bank transfer withdrawal is one business day. If the withdrawal is initiated prior to 1:00 p.m. on a business day, the funds generally arrive the same day. Otherwise, the funds will arrive on the next business day. Money can only be withdrawn to an account in the user’s name. The steps for withdrawing funds are as follows.

- Logging into the trading platform

- Clicking on the Deposit and Withdraw Funds button on the lower right

- Entering the amount of withdrawal and bank account details

- Initiating the withdrawal

Regulation and Reputation

The XTB review for both regulation and reputation is excellent. XTB is safe due to the regulation of the FCA, a financial authority in the top-tier. XTB is listed on the Warsaw Stock Exchange, has overall good customer reviews and an excellent reputation for security, fairness and available options. The regulation from worldwide financial authorities includes the FCA (Financial Conduct Authority) in the United Kingdom and the KNF (Polish Financial Supervision Authority) in Poland.

The licenses secured by XTB include many of the top financial regulators in the world. The list of XTB regulators includes:

- CySec for XTB Europe

- The Financial Conduct Authority for XTB United Kingdom

- The Comisión Nacional del Mercado de Valores for XTB Spain

- The Exchange Commission and Polish Securities for X-Trade Brokers DM SA, with supervision from Komisja Nadzoru Finansowego (Polish Financial Supervision Authority)

- Belize International Financial Services Commission for XTB Internationa

- Obtaining a license for the XTB South Africa Entity is in progress

- X-Trade Brokers DM SA has membership in ICS (Investors Compensation Scheme). If the broker becomes insolvent or declares bankruptcy, the ICS provides the clients with insurance. Due to the licenses issued by CySec and the FCA, all clients in Europe and the United Kingdom receive a cover of 20000 euro and £50,000 through the Investor Compensation Fund and the Financial Services Compensation Scheme.

- X-Trade Brokers DM SA must adhere to the license terms of the KNF applicable for services provided to countries in the European Economic Area. The licensing terms are strict, involving protecting both conflicts of interests and the funds of clients. XTB is required by the license to hold funds of clients in accounts separate from the funds of the company. An annual audit is performed by KNF to ensure XTB is solvent.

Trading Platforms

| Platform | Available |

|---|---|

| Web | Yes |

| Desktop | Yes |

| Mobile | Yes |

The XTB review for trading platforms is good due to the choice between the MetaTrader 4 platform and the broker’s own platform, the xStation 5. The largest retail trading platform anywhere on the globe is MetaTrader 4, although the learning curve for beginners can be steep. The MetaTrader 4 platform is excellent for analytical tools and trading indicators for the improvement of forex trading strategies. There is also a programming element included for automated trading.

Programmers have the ability to create custom robots or indicators to enable automatic trading. Programmers can also be hired for this purpose. One of the best features of the platform is the ability to test trading strategies. The user can then determine if their strategy requires additional optimization. MetaTrader 4 can be accessed through a web browser, smartphone, desktop computer or tablet.

The user has the ability to fully customize MetaTrader 4. If the user has a missing indicator, they can either download or build the indicator easily. Users with coding experience will be able to customize the indicators. Trading templated can be saved with only a few clicks of the mouse.

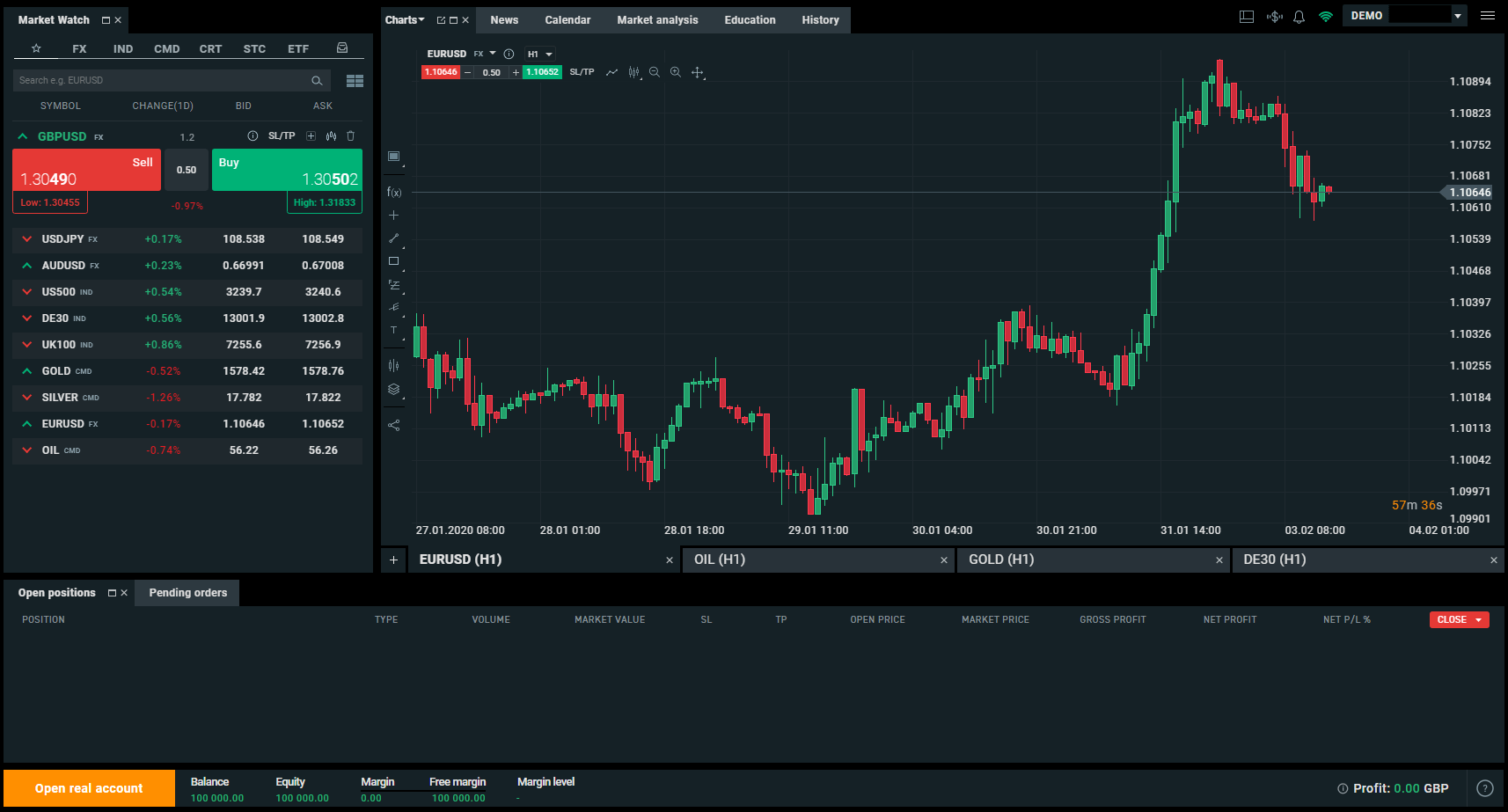

The XTB review for the award-winning xStation 5 is excellent. The platform offers easy to use and outstanding execution. Advanced tools and a trading calculator are included for technical analysis. The platform can be accessed through a web browser, smartphone, desktop computer, tablet or smartwatch. The layout of xStation 5 is friendly, enabling users to switch easily between charts.

Only a single click is necessary to open or close trades. The market research elements and analytical tools offered by the platform are good. The platform has a tab with the trading performance statistics of the user. A personalized market watch view can be created for easier access to assets the user is most interested in. Trades can be managed easily through the bottom panel.

Trades can be opened and closed, cash operations and trade history monitored, pending orders set and stop-loss orders controlled. In 2016, xStation 5 received the Best Trading Platform award from the Online Personal Wealth Awards. The order execution is fast at 85 milliseconds with no requoting.

Web Trading Platform

XTB offers a web trading platform in various different languages: Arabic, Bulgarian, Chinese, Czech, English, French, German, Hungarian, Italian, Japanese, Polish, Portuguese, Romanian, Russian, Slovenian, Spanish, Thai, Turkish and Vietnamese.

User Experience

The XTB web trading platform xStation 5 is a well-designed and user-friendly platform. The more you use it, the better you will like it. It’s highly customizeable.

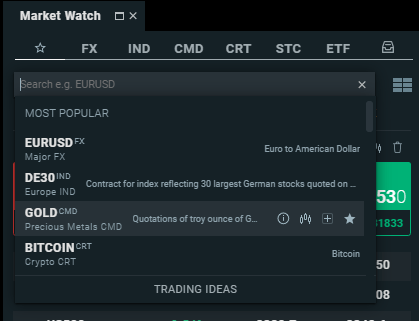

Search Function

We found no problem using the search function. It works well and without any problems.

Orders

When using the xStation 5 platform, you can use the following order types:

- Trailing Stop

- Limit

- Market

- Stop

Charting

The platform offers good charting options and tools. You have the option to use 35 technical indicators.

Desktop Trading Platform

Other than Trade.com and IQ Option, XTB’s xStation 5 offers a desktop version too. It’s the same as the web trading platform.

Mobile Trading

Mobile trading is supported by XTB. Traders have the option of trading with both the xStation 5 and MetaTrader 4 platforms using an Android or iOS device. The mobile version is a lot like the desktop version. The differences are in the small details such as the icons. The desktop and mobile charts look the same. The appearance of the mobile version is sleeker with a better scroll ability. The asset lists for both versions are the same.

Trading instruments can be found easily through the search bar with an asset list categorized in the upper area of the app. The news, education and calendar sections are all intact. A live chat function has been built directly into the app to enable the user to talk to customer support while on the move. The functionality of the mobile trading function is available for both demo and real accounts.

The search function for the mobile XTB platform offers a modern design and good search function. The only downside is no two-step authentication is available. A two-step login offers a lot more security. If the user has an iOS device, fingerprint authentication is easy to set. Unfortunately, Android devices are not currently offering this feature.

Both MetaTrader 4 and xStation 5 have mobile platforms for both Android and iOS. The user also has the ability to use their Apple watch. The same languages are available on both the web trading platform and mobile trading platform. The platform has a good look at feel. The mobile trading platform is well-designed and user-friendly. The user should have no difficulties finding all of the important features.

Only basic order types can be used on the mobile version. These are Market, Stop-loss and Limit. GTT (Good ’till Time) is the only order time limit available for the mobile platform. A wide variety of different notifications and alerts can be set such as notifications regarding important market news and price alerts.

Markets and Investment Products

A large variety of over 2,000 tradable assets are supported by XTB. The selection earns a good XTB review including stock CDFs, commodities, cryptocurrencies, currency pairs, indices and ETFs. One of the few drawbacks of the platform is the user is unable to change the product’s default leverage level. It is important to be able to manually change the leverage when the user wants to decrease the trade risk.

The user needs to be careful with both CFD and forex trading due to the high preset leverage levels. European clients have the ability to trade both ETFs and real stocks. The exceptions are the United Kingdom, Hungary, Cyprus and Italy. The selection of stock products is excellent. The broker offers 17 stock markets and 170 ETFs.

The research tools provided by XTB are user-friendly. The user has a choice of a wide variety of different tools to help them select the right instrument to trade for their specific needs. There are several recommendations for trading ideas available in the news flow. In most instances, the trading ideas are based on technical tools and for the short-term only.

There is no apparent structure for trading ideas. Even if a search is conducted for trading ideas regarding a specific asset, a lot of search results will appear. Finding the right one is not easy and generally requires some time. Only limited fundamental data is available on the platform. The user can find some basic facts including the debt/equity ratio and P/E ratio.

The user will not be able to access either operational metrics or financial statements. There are good charting tools available through XTB. Charts can easily be edited and saved. There are 35 technical indicators currently available on the platform.

Customer Support

A customer support desk is operated by XTB 24/7. Help can be reached by sending an email to sales_int@xtb.com or calling customer support directly at (203) 695-3086 or +48 222 739 976/ +44. Almost all of XTB’s platforms offer an option for live chat including the live trading platform, demo platform and mobile app. Residents of the United Kingdom have the ability to visit the broker’s physical branch for a consultation.

The XTB representatives are available at their office at 1 Canada Square, Canary Wharf, London E14 5AA, United Kingdom. Traders can also request assistance from any of the other 12 global offices. Online customer support is available in numerous international languages including English, Arabic, Italian, Russian, German, Chech, Spanish, French, Portuguese, Chinese, German, Slovak and Polish.

Traders can ask for assistance using social media channels. Contact can be made via Facebook direct messages and Twitter. According to the customer reviews, the response time for Live Chatt was only fair. Most of the users said a representative did respond in approximately five minutes. The XTB review regarding the customer service skills, knowledge and professionalism of the representatives is excellent.

User reviews were satisfied with the response of the customer support desk in the United Kingdom. The majority of reviews stated the customer service representatives were extremely professional with a full understanding of both the spread betting niche and FX. All customer questions were answered efficiently and thoroughly.

Although the response to the email option in the United Kingdom was good, the same is not true of many of the other countries. There were numerous reviews for some of the other countries stating the users were disappointed in the length of time necessary to receive a response to their queries.

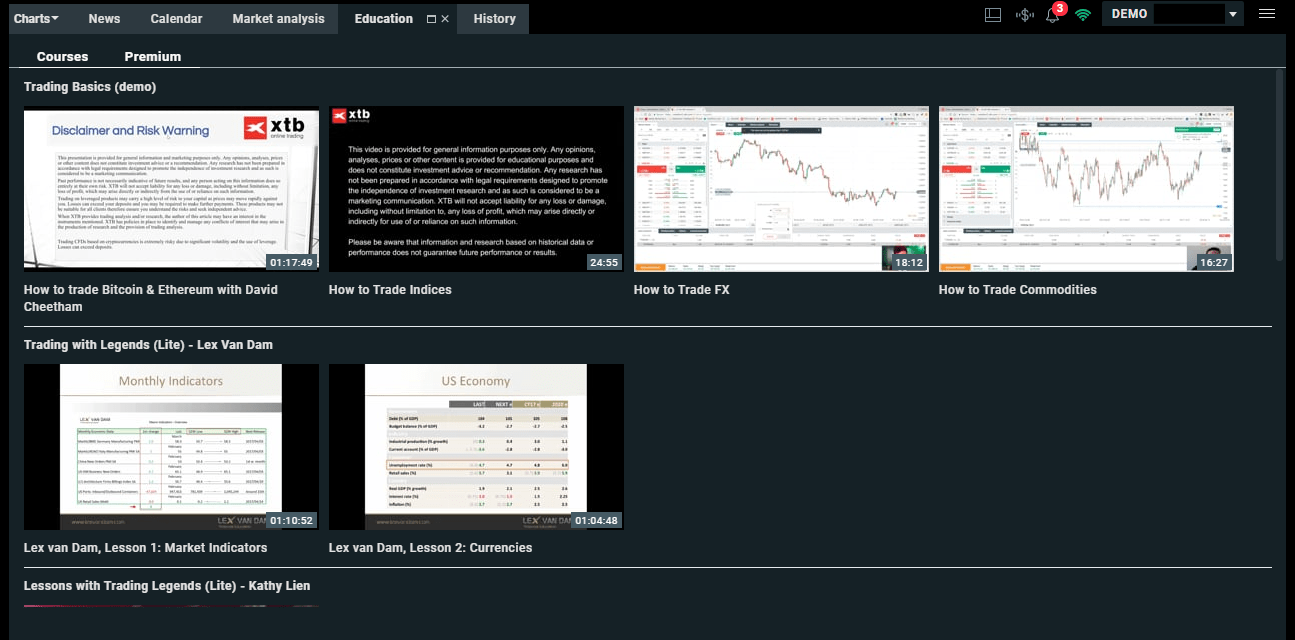

Education

The range of educational materials offered by XTB to their users results in a good XTB review. In addition to the Trading Academy section, educational videos are offered to the traders through the platform. The four basic sections of the Trading Academy are basic, premium, intermediate and expert. XTB also provides a free download from the trading library. The option is great for beginners. The intermediate section covers technical and fundamental topics. The site frequently hosts live webinars.

Pros and Cons

- Deposits and withdrawals are free and fast

- Opening an account is fast and easy

- XTB provides exceptional customer service throughout the United Kingdom. National testing conducted in 2020 all over the United Kingdom ranked XTB first out of 22 brokers.

- Fees for stock index CFDs and forex are low

- XTB was founded in 2002. The company is regulated and publicly traded ensuring the broker is low-risk and safe for CFD and forex trading.

- Multiple options are available for deposit including electronic wallets and debit or credit cards.

- The xStation 5 platform created by XTB offers an excellent selection of research and trading tools with exceptional usability. XTB is a good option for trading cryptocurrency due to the wide range of CFDs.

- Stock CFD fees are high

- The product portfolio is limited. XTB mostly covers FX and CFDs. Some European users have EFTs and real stocks as options.

- Email support outside of the United Kingdom is only fair

- The initial investment required by XTB is $250

- Only users with a basic account have access to guaranteed stop losses

The Bottom Line

This XTB review is definitely positive. The choice of brokers is critical for the success of the trader. XTB is an exceptional forex broker provided the user lives in one of the countries being supported by the platform. As a reputable broker, XTB takes the trading experience to a whole new level.

The trading conditions are transparent, with the broker having won several awards. XTB is extremely well regulated, makes certain all clients remain secure and is one of the most desirable trading platforms currently available.

User Reviews

Please stay away from this company as much as possible. I have Been trading with them for 5 years and I can say I lost a lot with them. The account manager assigned to me was constantly manipulating me and advising me to make bad trade choices so I lose money only for me to find out that my losses were beneficial to my account manager and the company. I still didn’t mind then until they finally closed my account and restricted me from withdrawals after I made a very huge deposit. It was really devasting and heartless losing all my fortune to this company during this pandemic. I couldn’t bear the loss so I had to search for a way to get my money back at least something. So stumbled upon this expert at ([removed]) who assisted me in sorting my ordeals with this broker. I expose this broker as much as I can so I can help other victims or intending victims out there.

Opened a demo account a few days ago and was given a very detailed guide on how to use it and what I should know about the platform whatsoever over phone by an account manager. Thankful for the guide, can only recommend to other beginners aswell!

Everything works super smooth and fine, perfect usability. I would not look around for another broker when you did not even try out XTB. Perfect, really can’t describe the trading experience any better!

Thanks for the detailed review on XTB and also testing the broker for us. Really enjoyed reading through it, very informative 🙂