AVATrade offers 50+ currency pairs with some of the best spreads among the competition.

| GBP/USD Spread | 1.6 pips (var) |

| EUR/GBP Spread | 1.5 pips (var) |

| EUR/USD Spread | 0.9 pips (var) |

| Assets | 50+ |

| GBP/USD Spread | 1.0 pips (var) |

| Oil Spread | 0.03 |

| Stocks Spread | 0.13% (var) |

| FTSE Spread | 0.5 pt |

You can trade 9 different cryptocurrencies with a maximum leverage of 1:20.

| BTC/USD Spread | 0.6% |

| ETH Spread | 0.6% |

| Leverage | Yes |

| Cryptocurrencies | 9 |

AvaTrade was founded as a global FX and CFD broker in 2006. The broker is regulated by numerous financial authorities including the Central Bank of Ireland. The broker was originally founded as AvaFX. AvaTrade offers clients spreads from average to competitive depending on the specifics of the trade. There is a wide selection of tradeable instruments available from numerous satellite offices in addition to the broker’s Ireland domicile. The financial registration encompasses five continents and six jurisdictions.

This AvaTrade review finds the broker excellent for new traders due to a combination of a $100 minimum for opening a new account and the commitment of the broker to education. The resources provided by the broker provide a good education regarding the basics and strategies required for trading. New traders can easily access the information necessary to initiate successful trades. The research and educational areas of the site have substantially increased during the last year including a much greater selection of market analysis, videos and free courses.

AvaTrade has become one of the most respected and largest online brokerages anywhere in the world. The company accepts clients from an exceptionally large number of regions. Trading accounts can be opened using a surprisingly wide range of currencies. Traders are accepted from the majority of countries including Australia, Canada, Denmark, France, Germany, Hong Kong, Italy, Kuwait, Luxembourg, Norway, Saudi Arabia, Singapore, South Africa, Sweden, Thailand, the United Arab Emirates, the United Kingdom and Qatar.

AvaTrade is currently unavailable for traders in Belgium, India, Iran, Iraq, Pakistan, the United States and Zimbabwe. The broker has four offices across the globe, located in Australia, the British Virgin Islands, Japan and Ireland.

Contents

Account Opening

Creating a new account is simple, easy and fairly quick. The broker offers clients the ability to try the AvaTrade desktop platforms, mobile and web platforms through a free demo account with no funding required. To open a demo account, the client must provide a name, phone number and email account prior to being able to use the account. Once the client decides to open a live account, a bank account connection is required for funding. Currencies from all the countries supported are accepted. Acceptable deposits are based on the location of each client including wire transfers and credit cards.

To open a live account, the trader must provide contact information including a utility bill a maximum of six-month-old to verify the address and a valid government ID. The ID copy must be valid and in color. The AvaTrade Multi-Account Manager (MAM) is available for clients with multiple accounts. Only one login is necessary for entering orders from any or all of the trader’s sub-accounts. The AvaTrade review for the variety of account types available is excellent. The accounts available Include:

AvaTrade Professional Accounts: Traders registering for an account with the broker are able to use pre-ESMA leverage as high as 400:1 for forex pairs and 25:1 for specific cryptocurrencies. The requirements for a professional account are meeting two out of three of the following.

- The financial portfolio of the trader must exceed €500,000 including cash and financial instruments.

- The client must show a minimum of one year’s experience as a trader in financial services.

- During the last four quarters, the trader must have initiated a minimum of 10 transactions of significant size.

AvaTrade Islamic Accounts: Islamic accounts were established to follow Islamic Sharia law. This type of account will not support trading cryptocurrency. Specific FX instruments will not be available to the account holder. An increased spread is included for all Islamic accounts for forex pairs.

Demo Account

The demo account is recommended by the broker for potential clients to learn how the platform works. Traders are provided with a means of improving their skills, learning about all of the instruments available and determining the best trading style for their specific needs. The AvaTrade demo account shows both market conditions and prices in real-time. The demo account will remain active for a period of 21 days. If the trader wants to extend the validity of the account, they simply contact their account manager or customer service.

Commissions and Fees

The AvaTrade review for commissions is exceptional because no commissions are charged by the broker. The average cost is 0.9 pips for trading EUR/USD forex pairs. The closer to $100 the trader comes, the more competitive the spread. The lowest acceptable deposit is $100. The broker offers slightly better costs and fees for CFD instruments including equity indices, individual stocks and commodities than the industry average. The typical spread for shares and stocks is 0.13 percent of the trade value.

| Description | AVATrade |

|---|---|

| Account fee | No |

| Deposit fee | $0 |

| Withdrawal fee | $0 |

| Inactivity fee | Yes |

The fee structure of the industry is generally a net charge for all overnight financing according to trades opened at 5 p.m. eastern time in New York. Theoretically, the fees are calculated using intrabank fees. The rates offered by the majority of brokers are generally not as favorable. The fees often make both position and swing trading expensive. AvaTrade offers traders complete transparency for overnight financing rates. The AvaTrade review from numerous users shows traders view this as a sign of trust.

The broker charges a fee for inactive accounts of $50 each quarter. When a trader does not make any trades for a minimum of three months, the fee will be charged by the broker. Overnight premium charges are incurred for all overnight CFD positions. Holding a position for the weekend will result in a three-day swap charge. The fee is charged to the account on Wednesdays. The overnight swap fees are dependent on the specific asset. The most current platform charge for stocks is between -0.0111 and -0.0166 percent.

The charge for the majority of indices and commodities is approximately -0.0042 to -0.0053 percent. The cost of ETFs is -0.0111 to -0.0166 percent and -0.0042 percent for bonds. The rates for cryptocurrency and foreign exchange are determined by the specific currency. This AvaTrade review finds the fees of the broker competitive for all types of clients including traders depositing larger amounts and those making minimum deposits.

Deposit and Withdrawal

| Deposit and Withdrawal Methods | Available |

|---|---|

| VISA / Mastercard |  |

| Credit/Debit Cards |  |

| Electronic Wallets |  |

| Bank Transfer |  |

A minimum deposit in the amount of 100 units of the base currency of the account is required for all deposits to an AvaTrade account. AvaTrade recommends traders open an account with a minimum balance between 1,000 and 2,000 of the base currency of the trader. To deposit funds, the trader first logs into their account then proceeds to the deposit section. The trader is then provided with a list of acceptable deposit methods including e-payments, wire transfers and credit cards. Traders located in the EU or Australia are not able to use the e-payment option.

Credit cards are not acceptable for deposits made by Canadian traders. The e-payment options for all traders other than those from Australia and the EU include Skrill, Webmoney and Neteller. The process for using a credit or debit card, bank account or e-wallet from someone else’s account is considerably more difficult, although possible. Additional documents for verification are required for all third-party deposits. All documentation must be submitted by both parties prior to an account being opened.

The process requires a color copy of both the back and front of the card showing the full name, expiration date and the first and last four numbers of the code. Both the CVV security code and the middle eight number of the card can be blocked. The chosen method of deposit determines the length of time necessary for completion. Deposits made using a credit or debit card are generally available immediately. One full business day may be required for the trader’s first deposit regardless of the method due to security verification.

Up to seven days may be required for wire transfers. The trader can track this type of deposit by providing a swift code receipt to AvaTrade. In most cases, e-payments are available within 24 hours. The trader’s account must be verified prior to making a successful withdrawal. Once verification is complete, the trader can log into the account and proceed to the withdrawal section. The trader must then complete the online form. Withdrawals require up to 24 hours for processing. AvaTrade adheres to the regulations for anti-money laundering followed by the other brokers.

The regulations state funds must be withdrawn using the same method used for the deposit. If the trader used a debit or credit card for the deposit, another method is unavailable until the trader has withdrawn a maximum of 200 percent to the card. If the deposit was made through a third-party, 100 percent of the withdrawal must be made using the same method used for the deposit. The length of time required for withdrawals is dependent on the method selected.

In most instances, the processing time required for withdrawal is between one and two business days. Up to 24 hours may be necessary for e-money withdrawals after processing. Debit and credit card withdrawals can require as long as five business days with as many as ten business days necessary for wire transfers. The speed of withdrawal is determined by both the country and the bank. Deposit and withdrawal processing time rate a favorable AvaTrade review.

Regulation and Reputation

The level of regulation for AvaTrade is considered extremely high. The regulations encompass six different jurisdictions. AvaTrade EU Limited is based out of Dublin, the Republic of Ireland as a private, Irish limited company. All operations conducted within the EU are controlled by AvaTrade EU Limited. AvaTrade EU Limited is regulated by the Central Bank of Ireland throughout the country. Ava Capital Markets Australia is based out of Sydney, Australia as a private, Australian limited company controlling all operations made by AvaTrade throughout the country.

AvaTrade Japan K.K. is based out of Japan as a Japanese company. All operations made by AvaTrade within Japan are controlled by the company. Ava Capital Markets is based out of Sout Africa as a South African company. All operations conducted in South Africa are controlled by the company. Ava Trade Ltd. controls all operations not conducted in any of the above countries. Ava Trade Ltd. is based out of the British Virgin Islands. The formal base of AvaTrade is in the EU. The membership of Ireland enables AvaTrade to conduct business throughout the EU, Japan, the British Virgin Islands, Australia and South Africa.

Forex and CFD brokerages based out of the Republic of Ireland are rare. The AvaTrade review is excellent due to the establishment of a solid financial services infrastructure and an exceptional level of regulation. One of the most common and more well-known bases for forex and CFD brokers is in Australia. AvaTrade has become established in several areas very few brokers are able to conduct business including Japan. The branch offices of AvaTrade are located in Australia, Chile, China, Ireland, Italy, Japan, Nigeria, Mongolia, South Africa and Spain.

AvaTrade has become one of the most highly recognized brokerages throughout the world regarding both reliability and reputation. Clients can conduct trades confidently. AvaTrade has won numerous awards including Best Alert System, Best Forex Broker of the Year, Best Customer Service and Best Financial Derivative. The broker has collaborated with Friedberg Direct to open up the Canadian market. Friedberg Direct is a member of IIROC, CIPF, the majority of Canadian exchanges and a division of Friedberg Mercantile.

Trading Platforms

| Platform | Available |

|---|---|

| Web | Yes |

| Desktop | Yes |

| Mobile | Yes |

The AvaTrade review for available trading platforms is excellent. The broker offers an impressive number of trading platforms. Every type of trader from beginners to experienced professionals can find a platform to suit their specific requirements. The trading platforms available through AvaTrade are:

- MetaTrader 5 platform

- MetaTrader 4 platform

- Meta Trader for mobile trading

- Meta Trader for Mac

- Meta Trader for web trading

- The AvaTradeAct platform

- Avatrade Trading Platform For Mac

- Avatrade mac mt4 login

The AvaOptions platform from AvaTrade is web-based, as suggested by the name. The trading interface offers numerous options including managing options and spot trades through the use of a single account, risk management features and trade options for more than 40 currency pairs in addition to precious metals. The desktop platform provides traders with advanced limit and stop orders for both put and call orders, customizable interfaces and overnight support for a maximum of 12 months. AvaTrade also offers a wide selection of automated trading software designed for the specific needs of every trader including:

- Duplitrade

- MQL5 Signal Service

- RoboX

- API Trading

- Mirror Trader

Web Trading Platform

AVATrade offers a web trading platform in several languages, including: Engish, Spanish, German, Portuguese, Italian and Russion.

User Experience

The platform is user-friendly and well-designed. It reminds us a little bit of the Plus500 trading platform – really similar if you compare those two. Although it’s not customizable, we really liked this platform, especially for beginners.

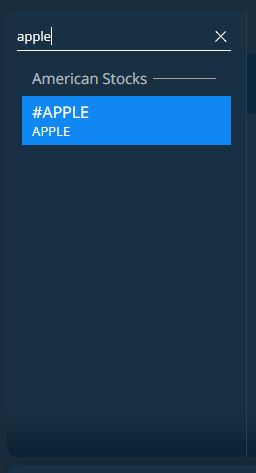

Search Function

The platform has an in-built search function, which works just fine. We had no troubles using it.

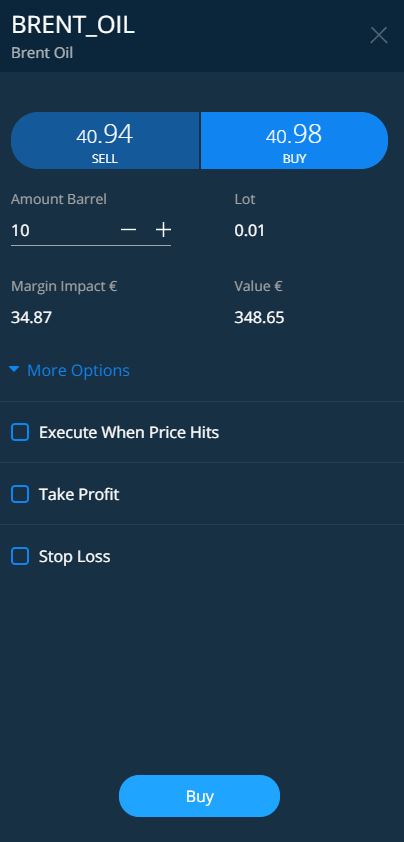

Orders

Making orders is compareable to all the other platforms. It’s fast and easy to understand. You can only use basic order types:

- Market

- Limit

- Stop

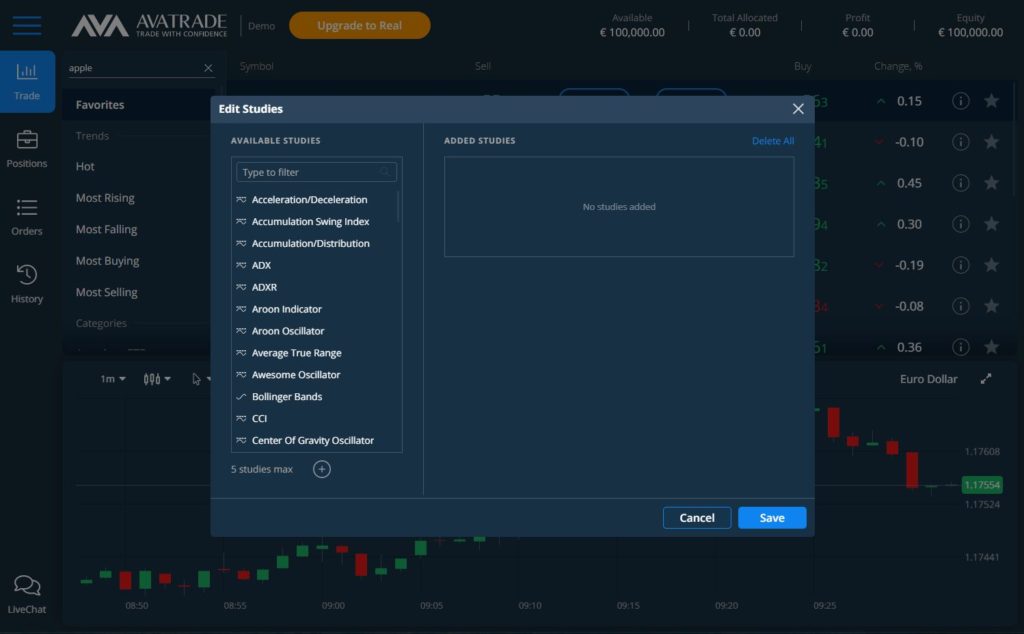

Charting

The platform offers a well-designed charting tool. There are 3 different chart-types from which you can choose. There are also quite some studies from which you can choose from.

Desktop Trading Platform

AVATrade offers a desktop trading platform (MetaTrader 4 and MetaTrader 5).

Mobile Trading

AvaTrade provides an easy to use and highly useful mobile app for both Android and iOS phones. The trader can visit their app store to download the AvaTrade mobile app. Once the trader has logged into their account, details can be viewed for a wide selection of different trades. The AvaTradeGo mobile app receives a good AvaTrade review due to the ability to support more than one account at the same time including several MT4 accounts. The best overall features are easy to access including quick trade entry, charting and watchlists.

Any traders not satisfied with the AvaTradeGO platform also have the ability to use the MetaTrader 4 mobile app supported by AvaTrade. The features available on the mobile lap are more limited than what is available for traders using either a desktop or laptop computer. This being said, there is a lot of value found with mobile trading for traders on the go. The primary mobile trading platform is the proprietary AvaTrade app. The AvaOptions app was launched to offer traders forex options.

The app for AvaTradeGo is extremely similar to the platform available on the web. The app offers AvaProtect, a feature for volatility protection. Traders are able to partially hedge trades to decrease their risk through a forex option. The default watchlists are extremely robust. Technical analysists are provided with 93 indicators for charting. The downside is no research-related content or fundamental news is available. This does detract slightly from the experience of AvaTradeGo as opposed to some of the other leaders in the industry.

Any traders with experience regarding options trading will enjoy the AvaOptions mobile app. The app eliminates the need for reading the standard options chain. AvaTrade has reinvented the way the desired strategy, time-horizon and strike price can be selected using just one screen. The UI/UX design for the AvaOptions app is impressive. The payoff diagrams would be better with explanatory notes. New traders may have difficulty understanding the diagrams. The AvaTrade review is still good due to the availability of 14 default strategy options for traders.

Once the trader chooses a strategy, the order-ticket is populated automatically including the options contracts available. The trader can drag the strike price lower or higher to implement the desired change. Another impressive mobile feature is the ability to choose the expiration date.

Markets and Investment Products

Traders can choose from among the following.

- Cryptocurrency is not available to Canadian traders. There are nine different cryptocurrencies available with a maximum leverage of 20:1. The cryptocurrency includes Bitcoin, Ethereum, Bitcoin Cash and Ripple.

- There are more than 50 forex currency pairs available 24/7 including all minors, majors and a decent selection of exotics. The spreads are competitive with leverage up to 400:1 and 0.8 pips available.

- Traders can access trading options through AvaTrade at all different experience levels. The low spreads and high leverage are competitive for trading financial assets. The complexity of options has been decreased. New traders will most likely be interested in the variety of trading opportunities available.

AvaTrade also offers stock options, CFD trading, ETFs, mirror trading, precious metals including gold, copper and platinum and a variety of other investment products.

Customer Support

There is a button for accessing Live Chat on the upper right of every page on the website. Live Chat can also be accessed through the account area on the AvaTrade website. The phone number for customer support is located just to the right of the button for live chat. The phone number is dependent on the location of the trader. The country can be changed immediately. To send an email or locate the phone numbers for every country and region, the trader must visit the About section and click on the Contact Us button.

According to the independent customer reviews, AvaTrade customer service has received a rating of average. The wait time necessary to speak to a customer service representative is not long. Some representatives are able to answer complicated questions easily where others are struggling. The AvaTrade review for professionalism is good. One of the best benefits of AvaTrade customer support is the company has physical locations all over the world. Traders have the option of walking into a physical location to speak with a real person.

Depending on the needs of the trader, trades can be conducted at one of the international offices. The help center page for AvaTrade offers a lot of details. The division of the FAQ section is according to the topic. No link is provided for the Help Center from any page of the website including the AvaTrade homepage. The only way to locate the section is by going to the search bar found on every page and entering FAQ. The FAQ section provides answers to the most frequently asked questions. In most instances, there is no need to contact customer support.

Education

The variety of educational resources provided by AvaTrade for developing or improving trader skills is exceptional. The sections include explaining economic indicators, a good selection of videos teaching trading, trading for beginners and a forex e-book. Every section contains extensive information. Trading for Beginners provides information regarding trading strategies, copy trading, trading stocks, currency trading, leverage, reading trading charts, comparing trading platforms, trading online, spread betting, paper trading, forex strategy, pips, short selling, psychology for online trading and trading budgets.

When a trader visits the AvaTrade website and enters the section for Trading Info, there is an exceptional section on analysis. The trader can then learn about technical and fundamental analysis. These skills are especially important for new traders. AvaTrade has an excellent educational section including a definition and comparison of different analyses. The reasons for performing a specific analysis are explained including descriptions of what the trader needs to do. Explanations for the trends traders are looking for are described in the section for technical analysis.

Pros and Cons

- Opening an account is fast and easy

- Exceptional education tools

- AvaTrade has an excellent reputation and outstanding regulation

- Withdrawal options and multiple deposits are free

- The social trading features are unique

- Customer support is provided in 14 different languages

- Only cryptocurrency, forex and CFDs are available

- Research and news functionality are not included in the trading platform

- The features for the desktop platform are limited for Mac Computers

- The research tools are limited

- Stagnant accounts are charged an inactivity fee

- The phone support is only fair

The Bottom Line

AvaTrade has been assisting traders with investments for over a decade. The platform offers a wide variety of instruments. The trader is able to choose the platform best for their specific needs. AvaTrade is reliable due to the regulations throughout jurisdictions across the globe. AvaTrade is one of few brokers offering cryptocurrency as well as forex and CFDs. Residents of the United Kingdom have the ability to execute spread betting. Although this is a lot like CFD trading, it is tax-free due to the gambling classification.

CFD trading is much more suitable for experience veterans than new traders. The good news is AvaTrade helps new traders understand the way the markets work. The broker enables traders to do a lot of research prior to conducting CFD trading. The demo account is ideal for testing the system. The trader is provided with $100,000 of fake currency to begin. The compliance to worldwide regulations and the lengthy history set AvaTrade apart from untrustworthy brokers and scams. This AvaTrade review is excellent.

User Reviews

There are no reviews yet. Be the first one to write one.