| GBP/USD Spread | 4 pips |

| EUR/GBP Spread | 4 pips |

| EUR/USD Spread | 3 pips |

| Assets | 50+ |

eToro uses overnight/weekend fees for CFD-positions.

| GBP/USD Spread | 4 pips |

| Stocks Spread | 0.09% |

| Oil Spread | 5 pips |

| S&P500 | 0.75 average spread |

eToro is well known for crypto trading. They offer the largest number of cryptos to trade with low spreads.

| BTC Spread | <1% |

| ETHSpread | <2% |

| Cryptocurrencies | <26 |

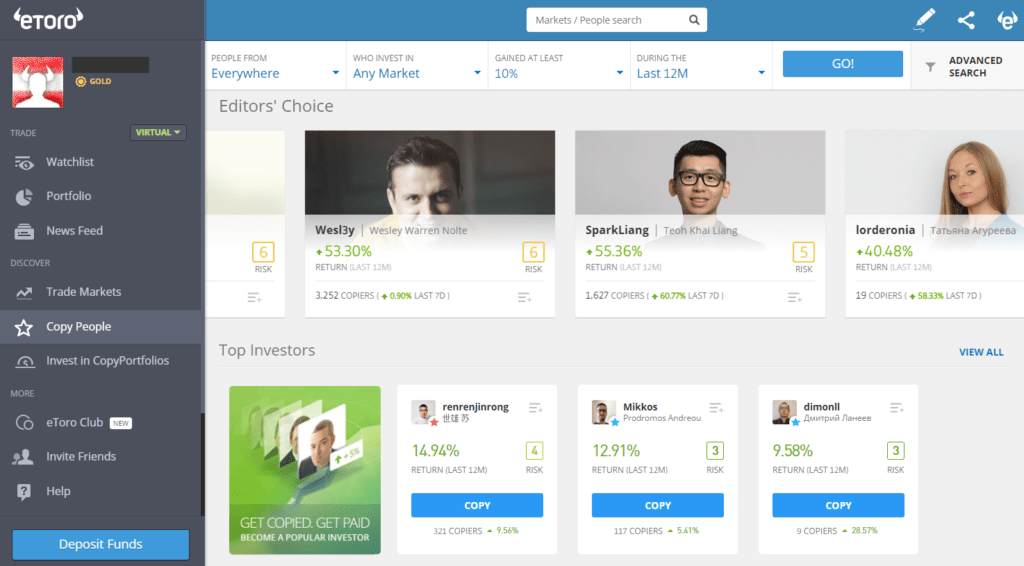

eToro is a simple to use and proprietary platform enabling the implementation of copy trading. The platform is ideal for traders interested in being copied while following rules for risk control. The accessibility enables holders of retail accounts to copy the trading strategies and trades of extremely successful clients both in real-time and automatically.

The other platforms have not integrated with the use of social media communication nearly as well. A lot of the users have left an excellent eToro review.

Contents

Account Opening

Most trading platforms require their clients to take numerous steps prior to being able to begin and eToro is no different. All of the typical information is necessary to open an account. The account then requires verification with proof of address, government-issued identification and a verified phone number. After the verification is complete, the client can then use the platform to begin trading.

Funds can be deposited in the account for trading using either domestic wire transfer or an online bank account. According to the platform. there will be more options for funding in the future. The easiest way to make a deposit is through online banking. Plaid enables clients to add a bank account to connect directly to eToro. Plaid is simply a third-party provider. When a deposit is made through a wire transfer, there are fees from the client’s bank.

The client must deposit a minimum of $200 when making an online banking transfer. This includes all future deposits as well as the initial deposit. If the client chooses wire transfer as a deposit method, the minimum per deposit is $500. The maximum deposit per day is $10,000.

Once all required documents have been uploaded and all necessary information submitted, account verification can take as long as two business days. All new clients must prove both identity and residence by uploading the specific documentation defined below.

- POI Document: A POI (proof of identity document) must include the client’s name, date of birth, the issue date and expiration date of the document and a clear photograph. The acceptable documents include a government-issued driver’s license or identification card and a passport.

- POA Document: A POA (proof of address document) must include the client’s full name, the logo or name of the company responsible for issuing the document and the issue date. The document can be a maximum of six months old with all four corners completely visible.

- POIS Document: A POIS (proof of identity and selfie document must be uploaded. The document must show the client holding the POI document uploaded to the exchange.

The acceptable POA documents are:

- Bank statement

- County, state or council tax bill

- Utility bill including gas, water or electric

Demo Account

Commissions and Fees

The two types of fees are non-trading fees and trading fees. Non-trading fees are charges with no direct relation to trading such as inactivity fees and withdrawal fees. Trading fees are incurred through trading including spreads, conversion fees, commissions and financing rates. The fees detailed below were calculated using the fees for selected products for a typical trade. The most frequently traded instruments for every asset class are included in this eToro review.

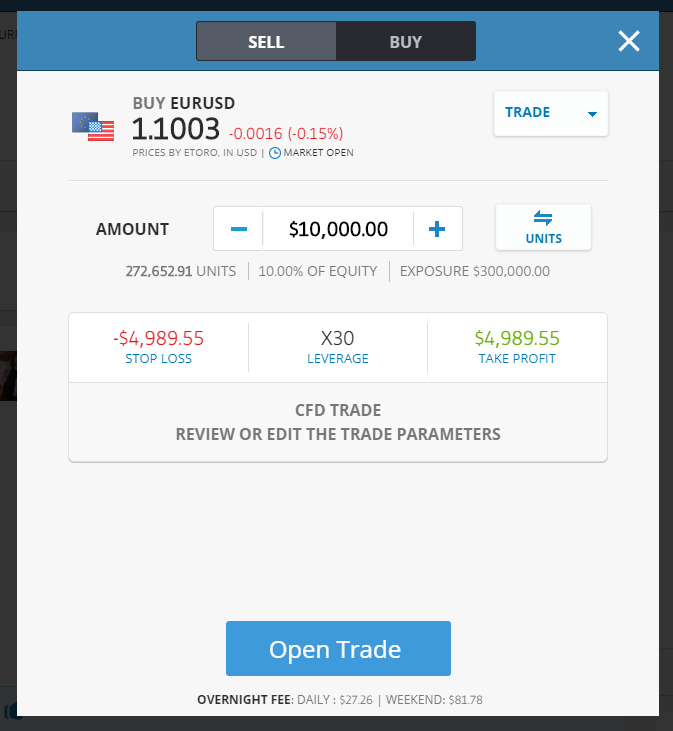

To perform a typical trade, the client purchases a leveraged position. The position is held for seven days prior to being sold. A $2,000 position has been chosen for the stock CFD’s and stock index with the position for Forex transactions at $20,000. The leverage chose is:

- 5:1 for stock CFDs

- 20:1 for stock index CFDs

- 30:1 for forex

The above benchmark fees including all broker financing costs, commissions and spreads. The eToro fees for the above are as follows.

Stock Fees

eToro is one of the more unique services available on the market. The platform offers zero-commission stock trading for European clients. The platform is also a CFD broker enabling clients to trade with real stocks when the leverage is set to one. Zero-commission trading is not available for clients outside of the EU. Both the fees and the spread are low. The spread is the difference between the bid and ask prices. When the leverage is set above one, the client is trading with CFDs.

Stock Commission for a $2,000 Trade shows the following result:

| Description | Fee |

|---|---|

| UK stock | $0 |

| US stock | $0 |

| German stock | $0 |

Non-Trading Fees

The non-trading fees are high due to the $10 charge each month if the client is inactive for 12 months. The non-trading fees are as follows, there is no account or deposit fee, there is an inactivity fee, the withdrawal fee is $5.

For more information on the fees, you can also compare all brokers on our broker comparison page.

| Description | eToro |

|---|---|

| Account fee | No |

| Deposit fee | $0 |

| Withdrawal fee | $5 |

| Inactivity fee | Yes |

Cryptocurrency Trading: The fee for exchanging fiat currency to cryptocurrency is five percent (four percent Simplex fee plus a one percent standard fee). The fee for converting cryptocurrency to cryptocurrency is 0.1 percent with a maximum trade of $10,000 and a minimum of $20 per transaction. The spread for trading cryptocurrency ranges from 4.5 percent for assets including IOTA and 0.75 percent for Bitcoin.

The most popular investor program offered by eToro has four levels beginning with cadet and finishing with elite. The client may become eligible to receive certain perks including a management fee, monthly payment and spread rebates. This is different than an active trader program with deposit or volume thresholds required. Traders are encouraged by the popular investor program to receive applicable incentives by producing successful results.

VIP Accounts: A VIP club membership is offered by eToro with five tiers beginning with gold. The final diamond tier is for traders maintaining a balance of $5k to $250k. The benefits vary according to the level including discounted deposit and withdrawal fees, a dedicated account manager and access to exclusive assets and private signals. This eToro review gives the VIP club an excellent rating.

For more information about fees, visit our detailed page: eToro fees.

Deposit and Withdrawal

The client can make a deposit for trading in an eToro account with either domestic wire transfer or through an online bank account. More options are expected to be added by the exchange during the near future. Plaid is the third-party provider used by the exchange enabling the client to open a new account with a direct connection to eToro. A wire transfer will require fees from the client’s bank to be paid.

The minimum investment required by eToro for an online banking transfer for all deposits including the initial deposit is $200. The minimum amount required for a deposit using a wire transfer is $500. The maximum amount deposited into the client’s eToro account per day is $10,000. eToro offers clients a wide range of options for making a deposit to the platform including:

| Deposit & Withdrawal Method | Available |

|---|---|

| VISA / Mastercard |  |

| Credit/Debit Cards |  |

| Paypal |  |

| Bank Transfer |  |

| Skrill |  |

| Neteller |  |

| Yandex |  |

| Giropay |  |

| Webmoney |  |

| China Union Pay |  |

A $5 fee is charged by the broker for all withdrawals. There may also be a credit card or bank charge. European brokers charge one of the highest fees for withdrawals. The minimum withdrawal allowed by the exchange is $50. The site provides clients with a fee page that is extremely easy to read fully disclosing all fees including withdrawals.

The client’s account balance can decrease quickly due to inactivity fees. Once there has been no trading activity for a period of 12 months, the client is charged a fee of $10 each month. The eToro Club program is offered to provide clients with additional services and certain discounts based on the size of the account.

Regulation and Reputation

eToro has a good reputation as an Israeli fintech startup. The social trading broker began conducting business in 2007. The FCA (Financial Conduct Authority) regulates eToro for clients served in the United Kingdom. The ASIC (Australian Securities and Investment Commission) provides regulation for Australians. Cypriot serves all remaining clients. CySec (Cyprus Securities and Exchange Commission) regulates CySec. eToro is safe due to the regulation provided by the top financial authorities in Australia and the United Kingdom. This eToro review finds the platform both reputable and reliable.

The platform provides clients with a nice range of tools to help them make responsible decisions. The tools encompass all experience levels while offering risk-management features and guidance for the initial steps. Precautions have been taken by eToro to make certain its client’s personal information and identities are kept safe. European banks keep traditional funds secure. During the time eToro has been in business, the exchange has been proven trustworthy. The platform is excellent for both beginner and veteran traders.

Trading Platforms

| Platform | Available |

|---|---|

| Web | Yes |

| Desktop | No |

| Mobile | Yes |

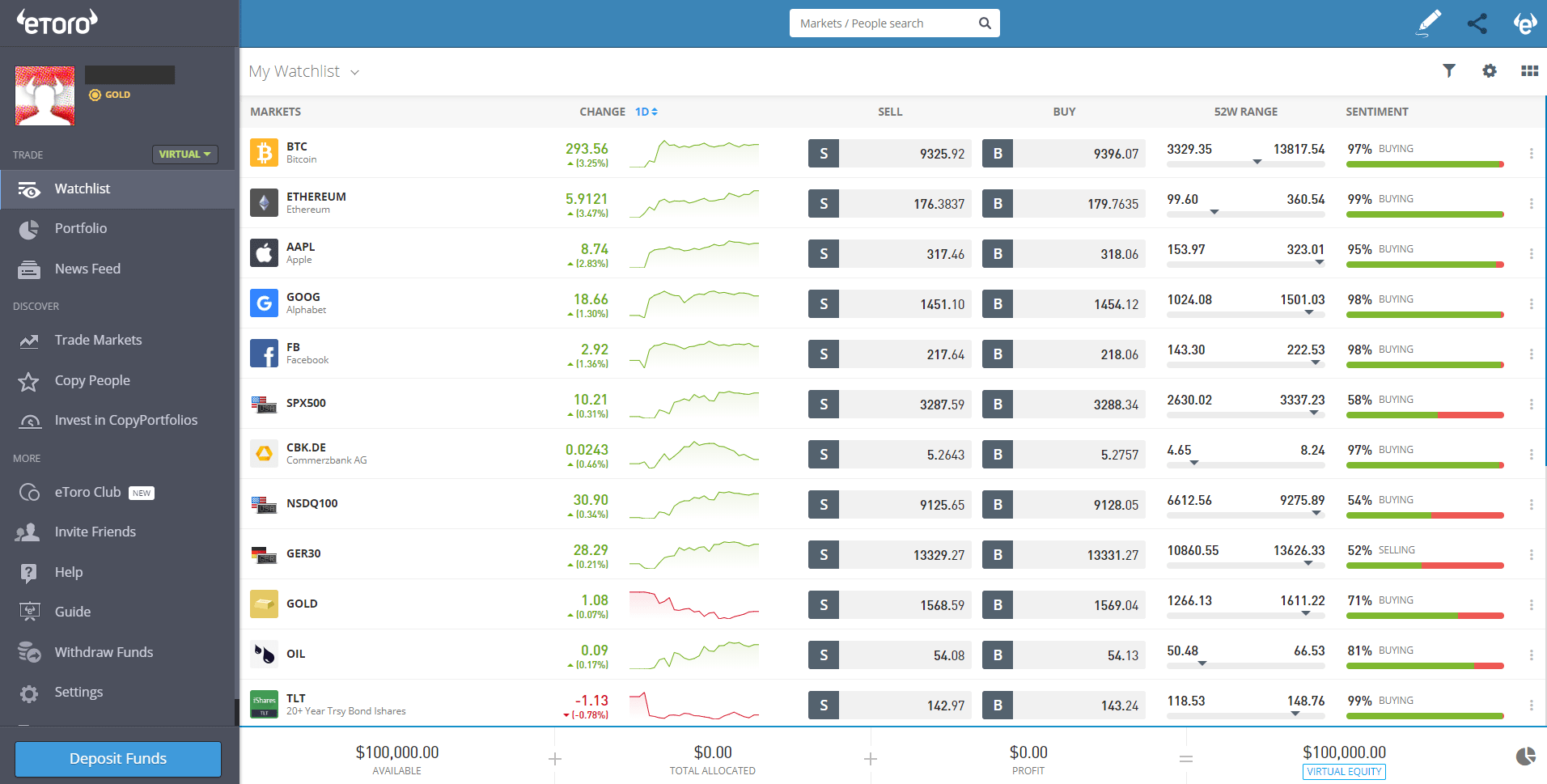

The social trading platform provided by eToro is based on the web. The platform was created to be easy to use as opposed to complex. The simplicity of the platform is appreciated by users of every level. There is no standalone version currently available.

The News Link opens up into a social forum. Although client posts are included, there is not much streaming or current news available. Clients have the ability to customize and save watch lists. There are no third-party or MetaTrader alternatives available on the platform. All of the watch list entries show clients purchasing and selling in real-time to enable fast sentiment analysis. In 2017, the CopyTrader program was joined by CopyPortfolios. Both can be automated to enable real-time mirror positioning.

Research is accessible using a blog featuring a lot of generic articles. The research could be more organized. The mobile app offers a research button with a message stating only funded accounts have access to analyst research. The most detailed topics are cryptocurrencies as opposed to either market analysis or Forex. Some of the articles provide technical or fundamental analysis.

The strengths of eToro include copy and social trading, automated portfolio copy and client trading and social sentiment data available on the platform. Negative balance protection is provided on a voluntary basis for professional clients since this is not required according to the rules of ESMA. The program is less expensive due to an omission of any volume discount program. The Etoro Club program is available offering additional services and specific discounts dependent on the size of the account.

The primary strength of eToro must be considered to provide a fair comparison between the other Forex brokers. The platform could make improvements regarding guaranteed stop-loss protection and order management. The protection would help traders decrease the risk of a big loss. This is especially true of the limited stop-loss functionality for cryptocurrency protection. This is one of the reasons this eToro review finds the platform efficient and fair.

Platform alternatives offering VPS hosting or an API interface would also improve the platform. For traders reliant on piggybacking the portfolios used by highly successful traders, the platform is exceptionally strong.

On March 7th of 2019, a blockchain wallet for both iOS and Android was launched by eToro. The wallet is available in 31 United States states. The platform provides trading with a maximum of 15 different cryptocurrencies within the United States and 16 for other countries. The cryptocurrencies available range from BTC (Bitcoin) to XLM (Stellar Lumens). The new feature increases the offerings to United States traders with an obvious focus being placed on cryptocurrency.

In the United States, clients are only provided with cryptocurrency access through eToro. Clients located outside of the United States are provided with the ability to trade stocks, CFDs, Forex and cryptocurrencies.

Web Trading Platform

eToro offers a web trading platform in a various different languages: Arabic, Chinese, Czech, Danish, Dutch, English, Finnish, French, German, Italian, Malaysian, Norwegian, Polish, Portuguese, Romanian, Russian, Spanish, Swedish, Vietnamese and Thai.

User Experience

The web trading platform is really well-designed and user-friendly. Users also have the option to do social trading.

Search Function

The platform offers a built-in search function, where you can type in any product you are looking for. The search works without any problems.

Orders

Making orders only takes a minute and is really easy. You can make the following orders:

- Trailing Stop

- Limit

- Market

- Stop

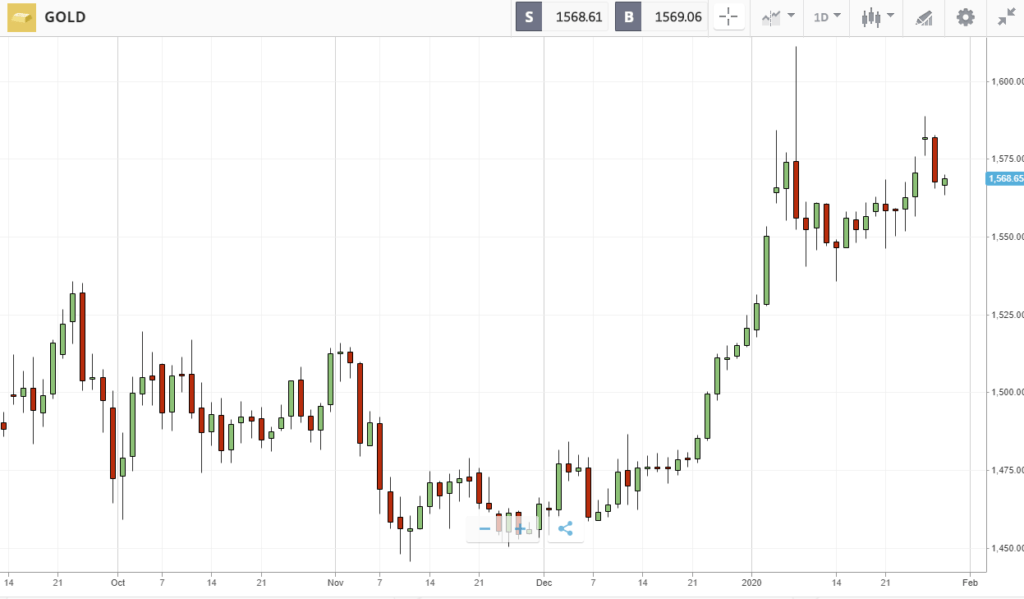

Charting

Charting has a lot of features including a wide range of drawing tools and 66 indicators. Although no backtest functionality has been provided with this feature, the platform offers performance data from both CopyPortfolios and CopyTraders.

Desktop Trading Platform

eToro currently does not offer a desktop trading platform.

Mobile Trading

The mobile versions offered by eToro for Android and iOS enable clients to sync easily between platforms. Although the menus are well organized, the customization is limited with less charting features. There are just five basic types available on the indicator menu. The order entry system is exactly the same as the web version. Unlike the eToro web version, no client positioning data is available on the watchlist. Custom price alerts can be set by the users in addition to receiving push alerts regarding account issues and market events.

Markets and Investment Products

The service offered by Etoro enables clients to trade nearly anything through just one platform. The platform is a social investment network combining interaction with the other users and a modern trading system. The intent of the platform is the disruption of a banking system long since outdated in addition to beginning a digital financial age. Any traders interested in cryptocurrency investments will find a lot of excellent resources available through the platform. A specific number of cryptocurrencies can be traded through the platform.

The eToro platform enables users to make investments in a lot of different assets including stock, indices, commodities, currencies and especially cryptocurrency.

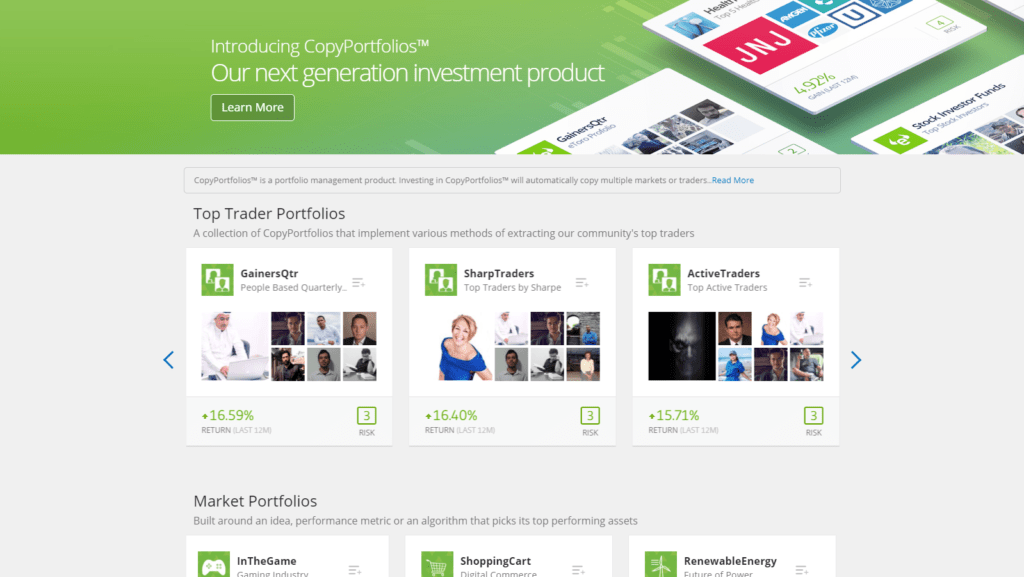

Copy Portfolio & Copy People

eToro added a unique twist to its platform by enabling users to copy and follow the other traders. This is the reason the platform has been classified as a social trading platform by both this eToro review and numerous client reviews. In addition to determining what each user wants to invest in, eToro has made two additional options available, investing in a CopyPortfolio and copying other traders.

CopyPortfolio is basically a product for portfolio management. There are a lot of similarities between making an investment in a specific index with a mixture of assets being chosen for the trader. Any investment made by the user automatically copies other traders or multiple markets with a predetermined investment strategy used for the basis. CopyPortfolios offers two different types of investments. The first is the best-performing assets from certain markets. The second is an investment vehicle eToro partners created.

To help minimize the risk for investors over the long-term, CopyPortfolios created diversified investments. After an investment has been made in a CopyPortfolio, eToro’s investment committee professionally manages the client’s capital. The gain potential for CopyPortfolio’s performance is maximized by being automatically rebalanced and analyzed in depth.

Customer Support

Clients can use an online support forum to connect with eToro. From there, a ticket can be submitted for a wide range of issues. Clients also have the option of calling the customer support line. A separate customer service program is available for clients through the partners. The online reviews for this customer service are fairly good. In some instances, it is extremely easy to reach customer service. In other cases, more time is required due to a surge in requests for customer service. Submitting a ticket is generally faster than attempting to reach customer service directly.

Education

As opposed to the more traditional top menu, the link for the Trading Academy can be found in the footer. There is also a link for a Live Webinar at the bottom of the page. The educational portal offers a PowerPoint style presentation in addition to 11 basic programs. The course for Advanced Technical Analysis offers a list of basic candlestick patterns including bearish and bullish designations. The only educational materials offered by eToro other than instrument and platform descriptions are located in the help databases and FAQ section. A YouTube library is maintained by eToro providing a tutorial section containing how-to presentations.

Pros and Cons

- Good variety of popular cryptocurrencies

- Free stock trading for clients in the EU

- Offers a good social trading experience

- Additional investment products are offered

- Opening a new account is seamless

- Accepts deposits using multiple payments

- Intuitive user interface

- The forex fees are high

- Base currency can only be used for one account

- The availability in the United States is limited

- Withdrawing funds is costly and slow

- Withdrawals must be made in fiat as opposed to cryptocurrency

The Bottom Line

The focus of eToro is on a lot more than just cryptocurrency trading. This eToro review finds the platform is extremely useful for anyone interested in trading or investing in cryptocurrency. The extra features provided by eToro give the platform a nice edge such as the various graphs and CopyPortfolios. The platform is appealing for beginners and veterans due to the highly intuitive nature. eToro is not a good choice for trading cryptocurrencies with less popularity, but the options provided are excellent for traders interested in using one platform for both cryptocurrency and fiat trades or major cryptocurrency options.

eToro is also an excellent platform for investing in different industries, pre-built portfolios or trading Forex and regular stocks. The platform enables cryptocurrency investors to buy and directly hold cryptocurrency assets. These options add to the value and positions of the platform. Withdrawals and deposits are generally processed reliably and accurately to ensure all funds remain safe. eToro has been proven to be a trusty platform in the industry for numerous years. Many of the reviews recommend trying out this platform.

User Reviews

i use to like the platform but many traders are dissapointed on Etoro for ristricting our rights to trade game stock,this’s very worrying and can’t go without punishment

will never forget this

eToro is great, especially for first time traders. I’ve found that their platform and user experience are very well, I could not really complain. There are no features I missed when I traded all assets. Altough pricing is very high (relative to other brokers), you also get a great experience with the customer support – always helping and does not take too much time answering.

The problem with all the negative reviews about eToro is that these reviews come from people who lost their money and are now angry at the broker itself. But as I always say – the broker only gives you the tool to trade, you do the trades and therefore – a bad trade is a mistake of yours.

Cheers

Outstanding customer service, can’t really add more here. Thanks a lot to the eToro support!

I really like the platform, it’s awesome especially the feature wher you can copy other people and see what other people are trading!

The trading platform is great for beginners. When I started I had little to no experience in trading, but the platform makes it easy because it is straightforward and I had no problems finding my way through the platform. Although results are not that great, but this is more of a problem because my trading strategy did not work the first few times 😀

I could not be happier trading at eToro, it has been an awesome experience so far. I started trading a few months ago (corona crisis) and made some good money. The trades are simple and easy to understand, the whole platform is built for beginners, which I found really good! The whole trading felt like a game I could not loose, which is great – really recommend!

Response from trustedbrokers.co.uk

Thanks for your review Janet,

we would like to inform you however that trading can in fact be really dangerous, and most people loose money when trading. So be careful and only invest the money you are willing to loose!

Cheers

I started trading at eToro a few months ago and made good money. The platform is well built, easy to understand and you can trade a lot of different assets. Although their stock offers seem interesting, it’s really not that good – because you only can trade big names like APPLE, MICROSOFT, …

But overall, good for cfd trading!

I used the corona crash back in March to educate myself because I always wanted to use my money and invest it. Guess what? I registered at eToro and opened an account to do exactly this – trade stocks with no commission. The site is really fun to use and easy to understand. I read some eToro reviews before and every review states that the broker does not have a large pool of stocks, but that did not bother me because I want to play “safe” and only invest in blue-chips. Can recommend!

Etoro itself is really good – I like the copy trading a lot, but there are so many ads, thats ridiculous! Please change that, because I’m paying for the service, so there should be like no ads at all!!!

easy and understandable. copy trading is well done 🙂