24option offers forex trading with over 45 currency pairs and variable spreads.

| GBP/USD Spread | 0.2 pips (var) |

| EUR/GBP Spread | 0.9 pips (var) |

| EUR/USD Spread | 0.2 pips (var) |

| Assets | 45+ |

| GBP/USD Spread | 0.2 pips (var) |

| Oil Spread | 1 Pip |

| Stocks Spread | 0.2% (var) |

| FTSE Spread | 1 pt |

You can trade crypto with tight margins.

| BTC Spread | 0.4% |

| ETH Spread | 0.5% |

| Leverage | Yes |

| Cryptocurrencies | <5 |

24Option was founded in 2010 as a forex broker. The company is owned by Rodeler Limited. This company is located in Cypress and offers regulatory benefits. 24Option is the second-largest player in the binary options world, only outsized by an Israeli company called Banc de Binary. Due to charges of fraud, this company was shut down. There have been numerous changes for 24Option during the past few years including removing binary options for its clients.

24Option has recently included additional investment types in its offerings. The expansion of the customer service department resulted in better technical support and improved management for large investment portfolios. The focus of the company is currently on forex trades including CFD trades and cryptocurrency Forex pairs. Although there is not a lot of information on the official website, 24Option appears to be a legitimate company.

The company is regulated by the Cyprus Securities and Exchange Commission. The company is not available for residents of the following countries.

| Countries | ||||

|---|---|---|---|---|

| United States | Japan | Australia | Canada | israel |

| Virgin Islands | China | Iraq | Iran | New Zealand |

| Bosnia | Puerto Rico | Ukraine | Ecuador | North Korea |

| Herzegovina | Panama | Belgium | Algeria | Uganda |

| American Samoa | Myanmar | |||

Contents

Account Opening

There are four different types of accounts available through 24Option in addition to a demo account. Each type has a different account minimum with the low end at $250 and a high end of $50,000. The account types in the higher-tier provide clients with better fees and offers. Certain accounts are preferable for the forex market while others are more appropriate for high-volume trading. The variety of account types alone is worth a good 24Option review.

- Basic Account: The best option for new traders or anyone interested in trying 24Option is a Basic account. There is a minimum balance required of $250. The trader receives access to certain educational materials and one free lesson. Webinar access is not included. Traders with a basic account are provided with a demo account and a balance of $100,000 for testing the platform. Every account type receives a free demo account. Traders also receive one free withdrawal and daily news.

- Gold Account: A Gold account offers better trading prices than a Basic account. Traders receive one monthly webinar and two basic lessons. A minimum $5,000 deposit is required with one free monthly withdrawal included.

- Platinum Account: A $10,000 deposit is required for a Platinum account. The trader receives the same perks available with the previous accounts in addition to someimprovements. Users receive better pricing, two monthly webinars and three advanced lessons. A Platinum account entitles the trader to three free monthly withdrawals.

- VIP Account: The VIP accounts are the most expensive and best account available with a $50,000 deposit required. This account provides traders with the best pricing available, five monthly webinars and five advanced lessons. Unlimited amounts can be withdrawn from VIP accounts without fees.

The larger the deposit, the more the trader receives. Opening a more expensive account offers traders valuable educational resources and much better prices. Every account type provides traders with access to Trading Central and daily news. This is an excellent tool for analyzing advanced markets. To open an account the trader must complete the online application and provide a full name, phone number and email address.

Due to IFSC regulations, the process of verification is mandatory according to AML/KYC requirements. This step can be completed by submitting one document for proof of residency and a copy of the trader’s ID.

Demo Account

The demo accounts offer traders the same functionalities as with a live account. The difference is the risk has been eliminated. Opening a 24Option demo account provides the trader with €100,000 in demo funds when signing up for an account. Traders can use demo funds to place trades in real-time conditions. 24Option does not currently have any time limits in place for demo accounts.

Commissions and Fees

The fee structure for 24Option is relatively high but fairly relative to the other brokers. Although four different account types are available, there are no significant discounts available for conducting larger volume trades. If an account becomes dormant the fees are high,. After six months, traders can be charged a maximum of €200 every month.

A monthly maintenance fee is charged by the broker of €10. After the initial withdrawal, the fee applied is approximately 3.5 percent. There is a minimum of $250 required to open an account. This 24Option review is good regarding no fees for deposits, financing or commission.

The withdrawal fees for 24Option are dependent on the type of account. All withdrawals made with a Diamond or Platinum account are free. The fees for many of the other withdrawal methods include:

- Wire transfer withdrawals are charged 35 GBP, 4,000 JPY, 35 EUR or 35 USD

- Credit card withdrawals are charged a fee of 3.5 percent

- The fee for Skrill withdrawals is two percent

- The fee for Neteller withdrawals is 3.5 percent

- The fee for Webmoney is 0.9 percent

- The fee for Qiwi is 3.5 percent

- Intermediary banks charge additional fees

If no transactions are placed for an account for a minimum of two months, 24Option will start charging inactivity fees. When an account is inactive for three months, the charge is 80 EUR. Accounts inactive for three to six months are charged 80 EUR. Once the account is inactive for six months or longer, the charge is 200 EUR. Traders must also pay 10 EUR for monthly maintenance. Once inactivity charges begin, maintenance charges are replaced.

There are no fees from 24Option for financing, deposits or commissions resulting in a good 24Option review.

| Description | 24option |

|---|---|

| Account fee | Yes |

| Deposit fee | $0 |

| Withdrawal fee | Yes |

| Inactivity fee | Yes |

Deposit and Withdrawal

24Option provides traders with a good selection of withdrawal and deposit options. In most cases, withdrawals are sent to the funding source. Prior to making a withdrawal, some type of valid identification and proof of address is required to ensure compliance with money laundering laws. If a credit card was used to deposit funds, card details are required prior to a withdrawal. Complaints and issues involving withdrawals are usually caused by delays in the process of proving identity.

These delays can be prevented by making certain proof of identity is complete before requesting a withdrawal. This will also enable faster withdrawals. Free withdrawals are available for Platinum and Gold account holders. Basic account holders only receive one free withdrawal. The fee for all other withdrawals is dependant on the method used and the percentage charge. A good example is the two percent charged by Skrill. Traders can place a request for a withdrawal at any time.

Deposits can also be made at any time with a minimum deposit of £250. Deposits are accepted for EUR and USD but once the account currency has been set, changing it is not possible. This 24Option review is excellent for the security of the company’s deposit process. 24Option has ensured depositing funds is fast and easy. The funds are available almost immediately to enable traders to take out options. There are 24 options available for deposits and withdrawals with a variety of methods. The deposit methods supported by 24Option include:

| Deposit Method | Available |

|---|---|

| VISA / Mastercard |  |

| Credit/Debit Cards |  |

| Skrill |  |

| Bank Transfer |  |

| Neteller |  |

| Diners Discover |  |

| JCB |  |

The requirement for KYC is required for CySEC by law for money-laundering prevention. This means the following documents are required for withdrawals.

- Photo ID: A copy of a government ID is required for withdrawals such as a passport or driver’s license.

- Proof of Address: All traders must provide a copy of a document confirming their address including official government documents, bank statements and utility bills.

- Credit Card Copies: A copy of both the front and back of any credit card used for funding is required by 24Option. This is necessary every time confirmation of a new method of withdrawal is necessary. If the same method is used in the future, the documentation already submitted is generally sufficient. Traders should allow one day for processing.

Regulation and Reputation

24Option is a responsible company and not a scam. This has been proven by the regulatory history of the company. The reason 24Option is no longer in the binary sector is for reputation maintenance. In terms of regulation, there are two regulatory agencies for 24Option. The CySEC or Cyprus Securities Exchange Commission regulates 24Option under CIF license number 207/13 received by Rodeler Ltd. The Belize International Financial Services Commission has jurisdiction over operations conducted outside of Europe.

Richfield Capital Limited has been issued authorization under IFSC/60/440/TS/15-16, the registration number for IFSC. The regulations provided by CySEC offer traders numerous protections not offered by unregulated exchanges or brokers. The most important protections include:

- Background Checks: Operators are required to take several different background checks. This includes when the holding companies and company directors applied for a license. 24Option was required to pass these background checks before a license was issued.

- Investor Compensation Fund: All companies regulated by the CySEC are required to contribute funds for shared investor compensation. This compensation fund offers protection for client accounts in case the brokers have unforeseen circumstances. The maximum compensation is €20k.

- Regular Reporting Standards: There is a lot more to receiving a license than simply submitting an application. Once 24Option was issued a license, the company is required to send the regulators updated reports constantly regarding its financial standing and operation.

- Segregation of Funds: From the perspective of the clients, the segregation of funds is extremely important. This makes certain that all deposits are kept in a separate account from the funds of the broker. If the broker were to declare bankruptcy for any reason, the funds of the clients are protected from directors and creditors.

In addition to clients knowing all of these checks were passed by 24Option, they have an authority they can contact if necessary. If a trader suspects their account is being mishandled by 24Option, they can report the company to CySEC. Complaints are handled efficiently through internal policies already in place.

Trading Platforms

| Platform | Available |

|---|---|

| Web | Yes |

| Desktop | Yes |

| Mobile | Yes |

24Option previously offered a trading platform with binary options powered by TechFinancials. Due to the expansion of product offerings, a proprietary platform is now available for forex trading services and CFDs called Scipio. This platform uses the same details for login. The MT4 trading platform has also been integrated due to the popularity of traders for CFD and forex markets. The key advantage of this platform is the integration of advanced marketing tools.

Traders can choose their platform based on the individual strengths offered by both. MT4 is more complicated to use but offers automation options and more tools for analysis. The Scipio platform is much simpler to use. Traders have the option of using one platform for research and the other for conducting trades. The login details for both platforms are the same.

Web Trading Platform

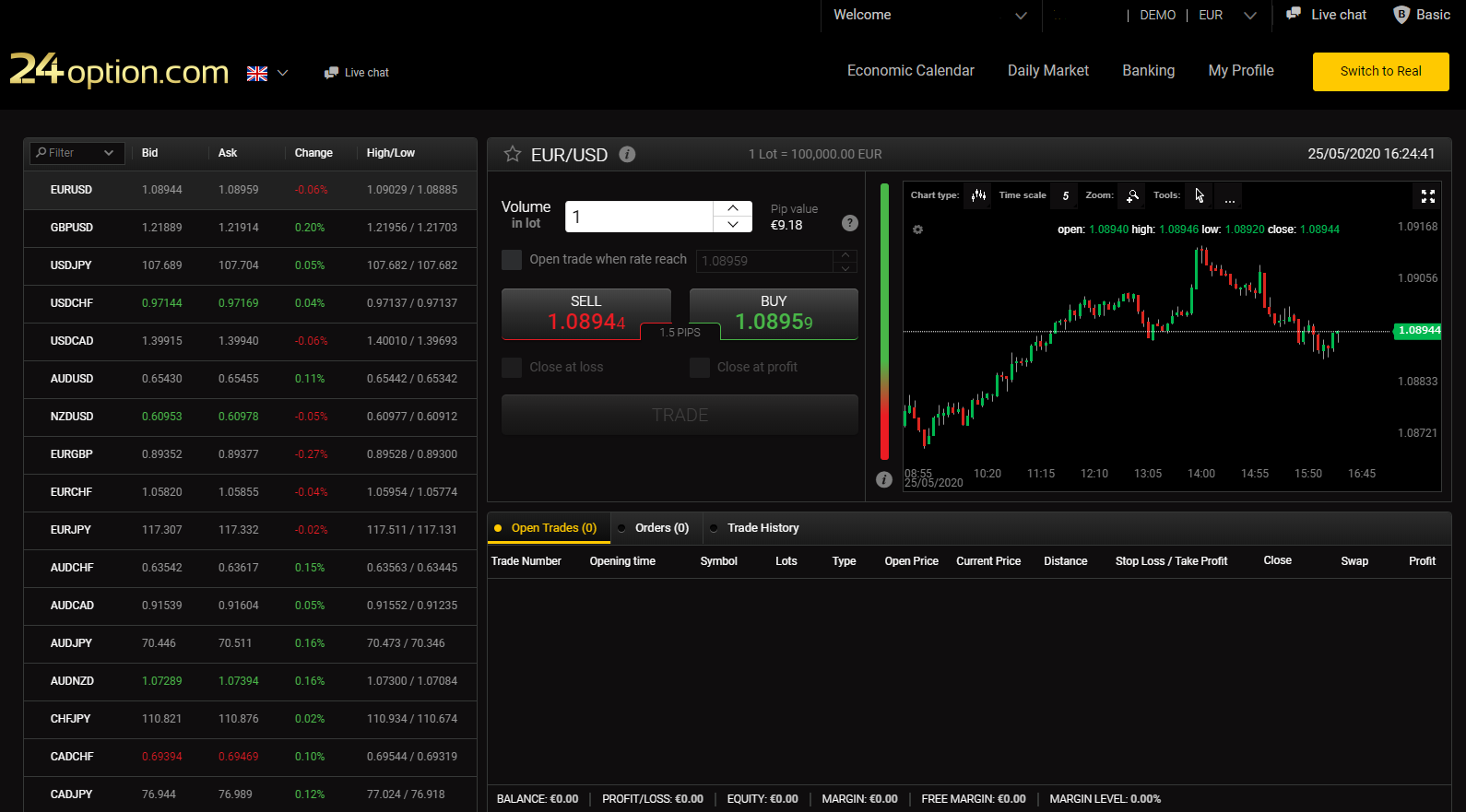

24option offers a web trading platform in various different languages.

User Experience

We found that although the platform has many different functions, the look and feel was a little bit off and not to the newest standards what we knew from other brokers.

Search Function

The trading platform offers a small search/filter function, which we found works good. We had no troubles using it.

Orders

Placing orders is really simple. You search for the asset you want to buy, click on it and an order interface pops up. You can then enter the volume and choose from some other options (like close at loss for example).

Charting

The platform offers various different charting functions, which are all shown when displaying a specific asset. One thing we noticed is that the platform only shows a small icon for each charting function, so you don’t really know which function it is unless you hover over with the mouse, so you can see a small popup. This is no big deal, but still, some improvements on this site would be nice.

Others

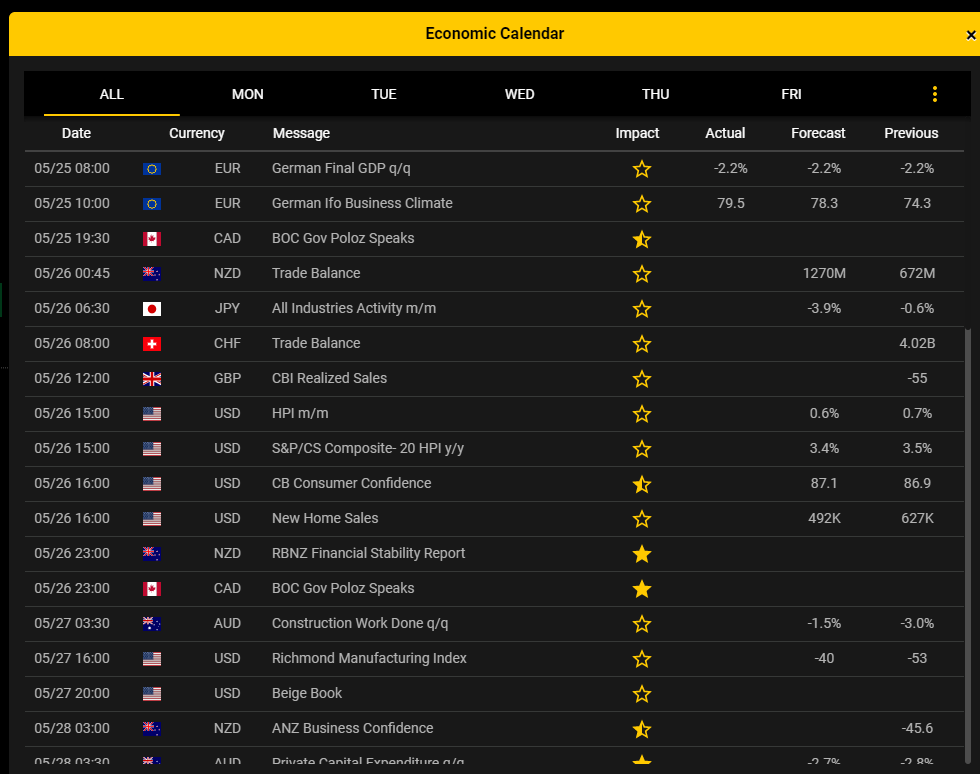

Our 24option review shows that the platform offers an economic calendar. The calendar shows important events in a more compact way. The platform also lets the user switch between the demo and real account with one click.

Desktop Trading Platform

24option offers a desktop trading platform (MetaTrader 4).

Mobile Trading

This 24Option review is good regarding the mobile trading app available to clients for free. The mobile app is compatible with iOS including iPad and iPhone and Android. Traders can download the appropriate app at the Google Play Store or the Apple App Store. The app provides traders with the same functionality as the official website including many of the features for account management. The mobile app includes a lot of the strengths and benefits of both platforms.

Functionality is maximized for every device with an intuitive and slick app providing a secure and fast login process. Using a smaller screen for technical analysis is difficult, but the details for trading and amending are clear and straightforward. This enables traders to take any steps necessary when a laptop or computer is unavailable.

The interface used by the app is simple, with trading procedures spread out for each phase. The large screens are effective and usable to decrease the chance of the user pressing the wrong button. Traders can use the app to open trades and view their trading history.

Markets and Investment Products

The 24Option review is excellent for the range of investment products. Despite offering fewer currency pairs, the company makes up for it with extensive cryptocurrency trading such as major currency pairs including:

- Bitcoin/GBP

- Bitcoin/EUR

- Bitcoin/USD

24Option also offers trading for more than 160 individual stocks. Additional standard trading products include oil and gold. 24Option offers a lot of the same commodities available through other providers at very competitive spreads. There is a large selection of tradeable assets including cryptocurrency, commodities, stocks, forex, indices and CFDs. The available cryptocurrency assets include:

- (BTC) Bitcoin

- (ETH) Ethereum

- (LTC) Litecoin

- (XMR) Monero

- (DASH) Dash

One of the best benefits of 24Option is single stock CFDs. This option is not available at the majority of other large CFD brokers. This is yet another reason this 24Option review is good. There are more than 60 companies clients can trade including:

- Apple

- Amazon

- Netflix

- Nike

- Ferrari

24Option is a Contracts for Difference or CFD broker. These are derivative instruments traded on the margin. This means the margin amount required for traders is a fraction of the trading size. Trading on the margin maximizes losses and gains because clients are trading with leverage. 24Option offers different leverage levels based on the region of the trader and their account type. Non-professional traders in the EU have a maximum leverage of 30:1.

Traders in other countries have a maximum leverage of 500:1. Any traders residing in the EU interested in more leverage than available can put in an application for a professional account with a maximum leverage of 400:1. The maximum lot size clients can trade depends on the pairs. Minor forex pairs can be traded for 10 lots and major forex pairs for 30 lots. The lot size for indices is three with 10 for stocks.

Understanding the 24Option protocol for stop out levels and margin calls is important for traders. The margin call level for all accounts is 100 percent. If the margin level is below 100 percent, the trader must deposit additional funds. Traders can also be prevented from opening new positions. If the position of the trader continues deteriorating and the stop-out level is reached, the positions will be closed out by 24Option. Stop-out levels are dependent on whether the client is a professional trader or a retail trader.

This means trading on the margin involves risks every trader should be aware of. Leverage can work in favor of the trader or against them depending on the specific circumstances. Trading profitability is directly impacted by spreads and fees. This is especially important when a trade is placed for a notional amount a lot bigger than the margin. 24Option has several different fees traders can incur. For this reason, it is important to understand what these fees are and how they are applied to client accounts.

A fixed fee is not charged by CFD brokers for the trading volume. 24Option makes a profit on the spreads available in between purchasing and selling the asset. These fees are different depending on the specific asset and the type of account the trader has set up. It is possible to establish approximate fees for live spreads charged by the 24Option platform. A few of the indicative spreads include:

- 23 points for gold

- 2.9 pips for CHFJPY

- 37 points for McDonald’s

- 275 points for Dow

- 1.0 pip for EURUSD

- 76 points for Boeing

- Two points for oil

- 122 points for Ethereum

- 4.0 pips for GBPAUD

- 3,624 points for Bitcoin

- 600 points for FTSE

This shows the spreads for many of the 24Option stocks and forex pairs are very reasonable. The spreads for crypto are much higher. A good example is the Binance exchange spread for Bitcoin is just 13.6 points. Only traders from certain countries are acknowledged by 24Option including:

- United Kingdom

- Hong Kong

- Italy

- South Africa

- Saudi Arabia

- Thailand

- Denmark

- United Arab Emirates

- Germany

- Sweden

- Kuwait

- Norway

- Singapore

- Luxembourg

- Qatar

24Option does not support numerous countries including:

- France

- China

- Australia

- Belgium

- Switzerland

- Japan

- United States

- Bosnia

- Brazil

- India

- Canada

- Iran

- Herzegovina

- Nigeria

- Israel

24Option has recently added CFDs to its platform. Marijuana stocks are now available for trading. The TechFinancial platform available earlier to clients has been restructured. The platform has been significantly improved with the addition of an option to trade CFDs. There is an important difference between the Forex and CFD platforms because leverage can be used by the traders.

Accessible levels are a maximum of x200. Any traders accustomed to the fixed risks of binaries will notice a significant change. Stop-loss tools are now available through the platform which is critical for the additional risks of leverage.

Customer Support

This 24Option review is good for the efficiency of customer support which is available to clients 24/7. Traders have options to contact the customer support team including the telephone, live chat and email. Localized support via telephone is only available for clients in certain countries including:

- Brazil

- Mexico

- Peru

- Colombia

- Singapore

- Russia

- Malaysia

- Chile

- United Arab Emirates

- New Zealand

- Belize

- Ukraine

- Saudi Arabia

Robo support is available outside of standard office hours. This is a good option for commonly asked questions. Traders can find this option in the bottom right corner of the majority of webpages. The broker site also includes a list of basic FAQs. Support for social media is available on Twitter. This is where a few of the most helpful videos for daily market briefings are located.

Education

24Option provides a good selection of education products for traders. The available videos explain numerous important concepts including CFD trading. A fairly wide range of other topics is covered by the other videos including:

- Trend analysis

- Support

- Pending orders

- Resistance trading

- Calculating pips

- Risk Management

24Option offers webinars a maximum of 10 times each month. A minimum of two is dedicated to intermediate and basic technical analysis. There is a different section specifically for forex trading including a glossary of the most important key terms for CFD trading and several other unique concepts. In addition to the trading strategies offered by 24Option for forex and CFDs, the company provides traders with a CFD glossary.

A guide for cryptocurrencies is included in the educational section with a detailed history of the cryptocurrencies most widely recognized. The guide offers fast reviews of 24Option cryptocurrency trading and the cryptocurrency market. The educational materials provided are fairly good including a decent selection of videos. The videos cover a wide range of topics.

Pros and Cons

- Daily financial news is easily accessible for traders through the Twitter feed on 24Option

- A calculator is available to determine pip value. Traders can view their exact profit or loss for every pip move

- 24Option offers traders promotions and bonuses

- A wide range of educational videos are available through 24Option

- Excellent payment options for foreign currency sets

- A maximum of 10 live webinars are available every month

- Live streaming news is not available through the mobile and desktop platforms

- No fundamental research is available

- The withdrawal and maintenance fees for 24Option are high

- 24Option charges clients inactivity fees

The Bottom Line

This 24Option review is good. The company offers clients its own platform for trading through web or mobile devices including iOS and Android. Traders can also use the popular MetaTrader4 platform. The company focuses on a wide range of assets and digital currencies including CFDs, forex and numerous cryptocurriencies. The trading platform is extremely well structured and provides clients with good customer service 24/7.

The reason 24Option stands out from its competition is both new and experienced traders will have no difficulty exploring and using the platform to conduct their trades. Clients interested in trading CFDs need to be aware a trading strategy is recommended to help prevent losses due to leverage. Overall, 24Option is a good platform offering traders a good variety of options and educational materials.

User Reviews

There are no reviews yet. Be the first one to write one.