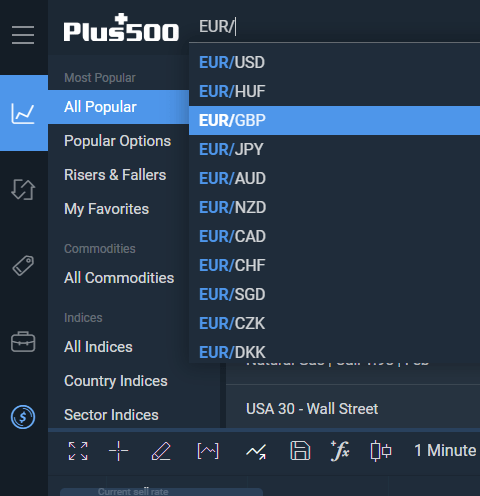

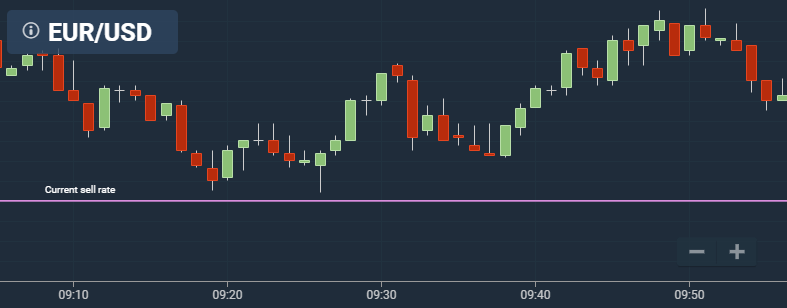

Plus500 offers forex trading via CFDs. Again, there is no commission, everything is included in the spreads.

| GBP/USD Spread | Variable |

| EUR/GBP Spread | Variable |

| EUR/USD Spread | Variable |

| Assets | 70+ |

Plus500 has low CFD trading fees. The broker has no commission: everything is included in the spread.

| GBP/USD Spread | Variable |

| EUR/GBP Spread | Variable |

| Stocks Spread | Variable |

| Oil Spread | Variable |

Plus500 is a Israel based broker reputed for offering high-rated Contracts for Difference (CFDs). The contracts are regulated by notable financial sector authorities such as the Israel Securities Commission, Market Authority of Singapore, Cyprus Security Exchange Commission and the Financial Conduct Authority (FCA). The FCA is a large regulatory authority that covers three jurisdictions, namely; the UK, Germany and Ireland. The company runs regional offices in Australia, Singapore, Cyprus and Israel.

In line with its core product offerings, Plus500’s vision is to become the number 1 global provider of CFD’s (By total number of relationships with UK CFD traders. Investment Trends 2020 UK Leverage Trading Report). The company was founded in 2008 after unveiling a Personal Computer based trading platform. The web version of Plus500 are specially modeled on simplicity. The CFD provider currently plays host to a large client portfolio of over 304+ thousand active people (2018).. Most of the traders are based in Europe and Asia. A careful Plus500 Review of the company’s highly successful business strategy is grounded on:

- Continued acquisition of new clients while retaining actively engaged clients

- Increasing market share and exploring new market fronts

- Increasing trading volume across all the CFD instruments

- Strengthening the operating model to boost the overall financial performance

- Investing money on innovation and Research and Development (R&D)

This Plus500 Review shows the broker’s trading platform supports over 20 tradable assets, including forex, shares, ETFs, indices, forex, commodities and options.During the same year, Plus500 Ltd (LON: PLUS) listed on the London Security Exchange (LSE) and is currently a component of FTSE250. In 2015, Plus500 Group added CFDs on options and unveiled the widely touted rollover function.

As part of efforts to guarantee trust, funds from clients are kept in segregated in bank accounts and secured with SSL. The Plus500 platform is can be accessed using Android App, Windows Phone App and Web Trader. A demo account is available for risk free trials. Customer service support is available on 24/7 basis. The stiff regulations that govern the company operations have added to make the Plus500 trading platform a reliable CFD platform.

The group introduced a new homegrown Web Trader targeting mobile and desktop device users in 2015. These efforts have gone a long way to enhance user experience. A quick Plus500 Review also reveals: tight spreads, no commission trades, quick and reliable order execution and a leverage of up to 1:30.

Contents

Account Opening

Opening an account at Plus500 takes less than a day to complete, according to our broker review. The broker offers real money and demo account modes. Some of the pros of opening a real money account include: access to credit and debit card, no deposit fee and opportunity to make up to 5 withdrawals each month. Experienced traders can apply for professional account, which is governed by a different set of rules when it comes to eligibility and other requirements.

The fully digitized Plus500 trading platform charges low minimum deposit. The funds deposited in the account are held by Plus500UK Ltd in strict adherence to the financial regulations set by the Financial Conduct Authority (FCA). The broker accepts traders from more than 50 countries and territories. To get registered, users are required to provide personal information ascertaining their identity and residency.

The entry can be done by uploading and submitting a copy of ID and other requested information. Once the account is created, all you need to log into the system is enter your email and password. Users can also sign in via social media accounts like Facebook and Gmail. The broker accepts a wide range of banking methods (deposit and withdrawal) for user convenience. Besides credit and debit card, the other deposit options available include: PayPal, Skrill, and bank transfer.

Demo Account

Commissions and Fees

The fee regimens approved by Plus500 are broadly classified as either trading fees or non-trading fees. The trading fees are exercised during the trading sessions and include commissions, conversion fees and spreads. The non-trading charges are not directly linked to trading. The main charge here is the inactivity fees. It is important to reiterate that Plus500 investment products do not charge commissions. However, if a commission is applied, the deduction is usually made up-front. The company mostly recoups its charges through Bids/Ask spreads attached to the trading instruments.

To check the Bid/Ask spreads, simply log into your account and find the specific instrument you want under the detail section. Depending on the selected trading activity, the broker may apply the following charges: guaranteed stop order, currency conversion fees, overnight funding and inactivity fee. Some of these tools can be used to control pricing and limit negative market exposure. Overnight funding is only ever deducted. Guarantee stop order is a risk management tool that ensures the closing market position matches the requested recovery rate.

The tool also gives users a view of the maximum possible losses, which may be incurred on any given trading position. The other popular risk management tool that is offered by the broker is the Trailing stop. The freely available tool automatically places a limit on the traded losses while locking the already accumulated profits. The performance of the Trailing tool is dictated by many factors; among them is “Slippage”. Experienced traders often use this phenomenon to intervene in the trading after a major market news or a volatile trading session. The tool is effective in a variety of financial instruments.

| Description | Plus500 |

|---|---|

| Account fee | No |

| Deposit fee | $0 |

| Withdrawal fee | $0 |

| Inactivity fee | Yes |

The Plus500 Review instruments include indices, forex pairs and stocks. Being one of the most competitive players in the CFD market, the broker charges a low inactivity fee of $10. Unless specified otherwise, the non-trading fee is normally added to trading accounts that stay dormant for a net period of 3 months. The low rate also applies to key trading assets like Europe 50 CFD and S&P 500 CFD. Europe 50 futures CFD tracks top 50 leading Euro STOXX listings. Traders interested in the CFD can view critical information such as trader sentiments as well as information about the spread, leverage and overnight funding buy and sell.

For more information about fees, visit our detailed page: Plus500 fees.

Deposit and Withdrawal

Traders are required to pay a minimum deposit of $100 before executing any trade. This Plus500 Review shows the broker has a fairly elaborate banking support featuring a variety of deposit and withdrawal methods. The broker does not charge a deposit and withdrawal fees. However, traders may incur a fee if they exceed the no fee number of withdrawals. Traders may also incur charges when making money transfers, but such charges are rare since most are carried by other parties such as the payment issuer and the assigned bank. The asset classes issued by the broker are priced differently, so taking time to analyze how the prices are stacked is critical before making any market move.

A Plus500 Review of Deposit Methods:

| Deposit Method | Available |

|---|---|

| VISA / Mastercard |  |

| Credit/Debit Cards |  |

| Paypal |  |

| Bank Transfer |  |

| Skrill |  |

Note: The credit/debit card withdrawals typically take 2 business days to complete. The amount of deposit you can have in your trading account may be limited by the appointed funding option. For most part, large deposit can be easily made through bank transfers.

A Plus500 Review of Withdrawal Methods:

| Withdrawal Method | Available |

|---|---|

| VISA / Mastercard |  |

| Credit/Debit Cards |  |

| Paypal |  |

| Bank Transfer |  |

| Skrill |  |

Note: the broker charges zero dollars for the first five withdrawals a month. Once the withdrawal ceiling is surpassed, a $10 fee is accessed per withdrawal. The minimum withdrawal for bank transfers and credit/debit cards is capped at $100 while that of PayPal is set at $50. The broker’s user agreement does not say anything about the maximum withdrawal amount, so the limit may not apply.

Regulation and Reputation

The company is regulated by various authoritative jurisdictions that can be traced to the UK, Singapore, New Zealand, South Africa, Israel and Cyprus. Plus500UK Ltd authorized & regulated by the FCA (#509909). You do not own or have any rights to the underlying assets. Please refer to the Disclosure documents available on the website. Also, the entities include the Cyprus Security and Exchange Commission (CySEC) and the Australian Securities and Investments Commission (ASIC). The company operations are served by three main subsidiaries, Plus500UK Ltd, Plus500AU Pty Ltd and Plus500CY Ltd. One of the trading strategies that are not encouraged by the system is scalping. Under the strategy, several consumer positions are opened and closed in a space of 2 minutes. Traders who engage in scalping may have their accounts blocked or closed indefinitely. The company does this to clamp down on negative speculation and dishonest trading practices. The strict regulatory environment has made it difficult for the broker to offer bonuses and promotions.

Trading Platforms

| Platform | Available |

|---|---|

| Web | Yes |

| Desktop | No |

| Mobile | Yes |

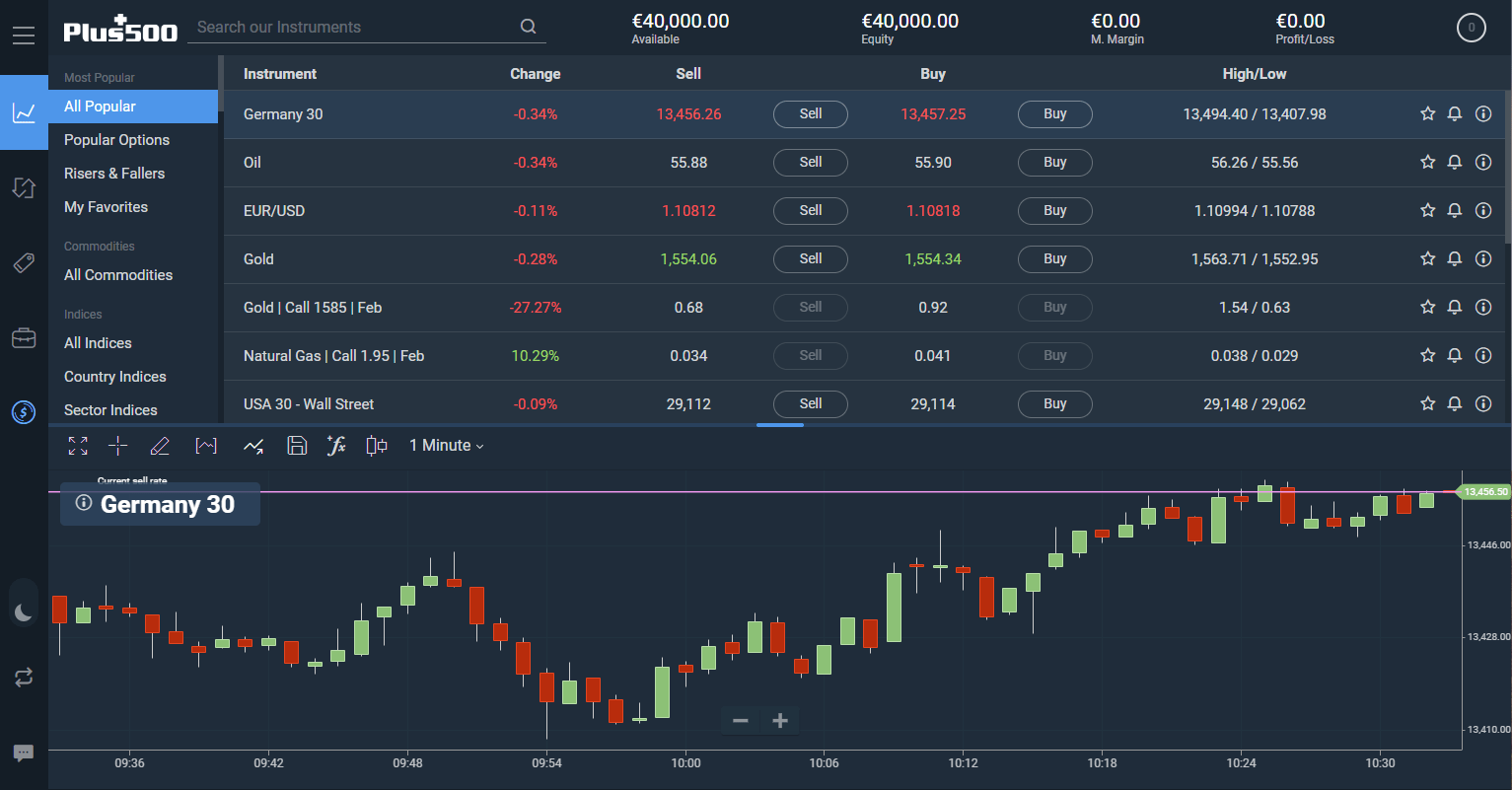

To enhance the online trading experience, Plus500 offers the following key trading features: virtual trading demo, proprietary platform and web platform. Using the demo, beginning traders can spend unlimited time learning about the broker and the various CFD instruments. Experienced traders, on the other hand, can use the tight dealing spreads to string together a profitable market moves. The trading platform features over 100 charting indicators; 21 charting drawing tools and 15 watch lists. The drawing tools are helpful in making technical analysis. Plus500 continues to improve its watch list to help traders capture the market defining trends. Unlike other trading platforms in the market, Plus500 uses own proprietary trading platform and does not support automated trading.

This comes in spite of the growing popularity of non-proprietary MetaTrader among the ranks of financial brokers. In terms of trading strategies, Plus500 offers time-tested strategies such as Swing trading, Day trading and Position trading. These strategies are carefully structured to help traders reap optimal rewards from everyday trading. Through Day trading, investors can perform multiple small size trades on shorter time allocation. Position trading gives traders a snapshot of a few large size trades that can be held for a lengthy period. Using this medium term holding strategy, traders can maintain a position lasting anywhere from a few days to several months. Swing trading is another powerful strategy helps investors to capture a positive market trend after a lengthy trading session.

Web Trading Platform

Plus500 offers a web trading platform in various different languages: Arabic, Bulgarian, Chinese, Croatian, Czech, Danish, Dutch, English, Estonian, Finnish, French, German, Greek, Hebrew, Hungarian, Icelandic, Indonesian, Italian, Japanese, Korea, Latvia, Lithuanian, Malay, Maltese, Norwegian, Polish, Portuguese, Romanian, Russian, Serbian, Simplified, Slovak, Slovenian, Spanish, Swedish, Traditional Chinese and Turkish.

User Experience

The plus500 web trading platform is really well-designed with a modern, clean look. Anyone can find their way through the platform in a few minutes without a problem.

Search Function

The web trading platform offers a search function, where you can search for any product you want to invest. The search function works well and we had no troubles using it.

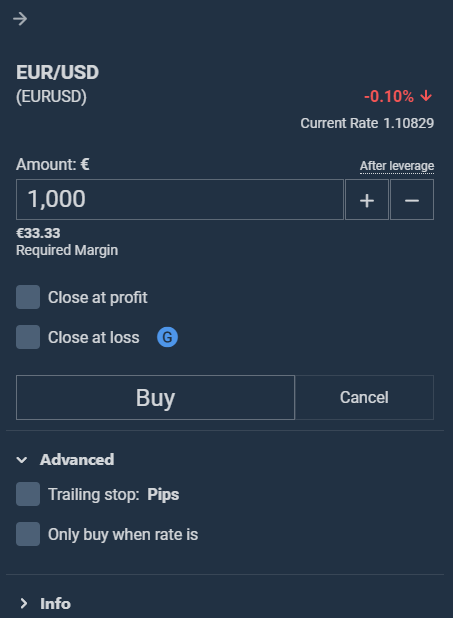

Orders

When using the web trading platform, you can use the following order types:

- Trailing Stop

- Close at Profit

- Close at Loss

Charting

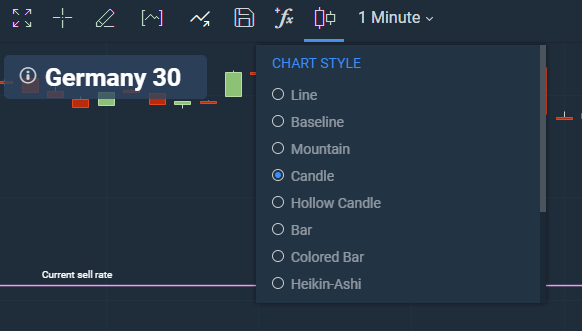

The platform offers a charting tool, which we found really well built. There are 103 indicators/studies in total. You also have the option to trade from the chart and save specific charts. There are also 13 chart types in total from which you can choose.

Others

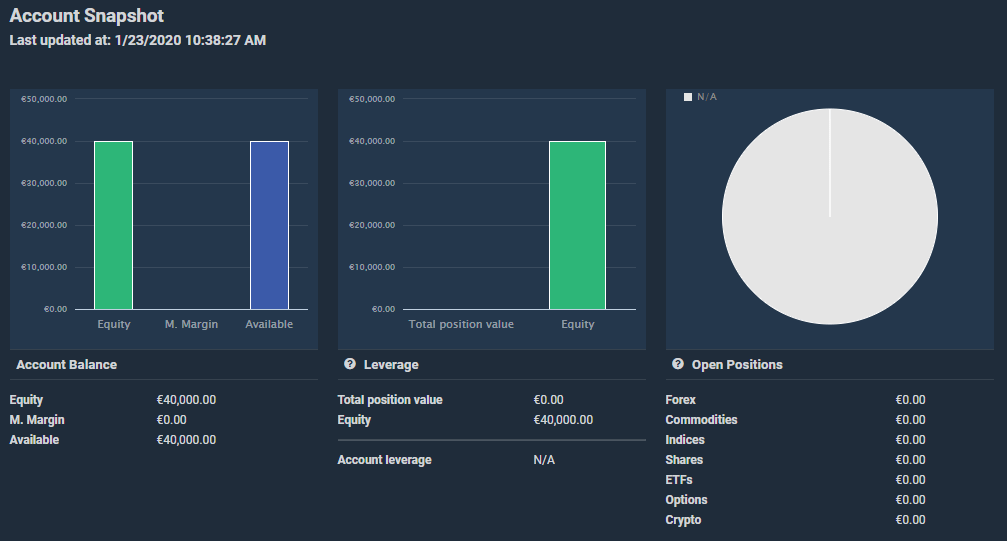

Within the platform, you also have the option to create an account snapshot, where you can see your account balance, list of open positions and your total equity.

Desktop Trading Platform

Plus500 currently does not offer a desktop trading platform.

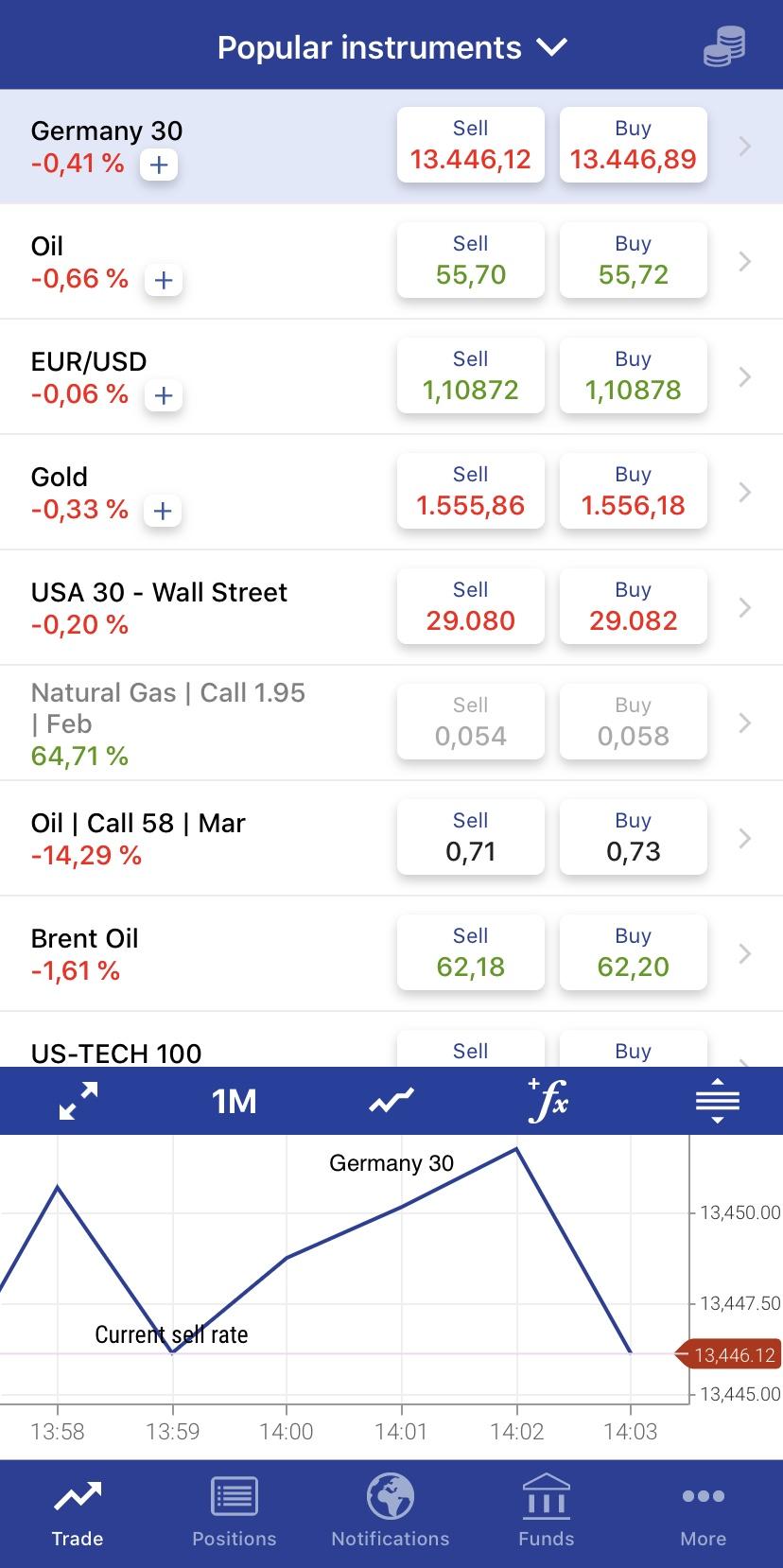

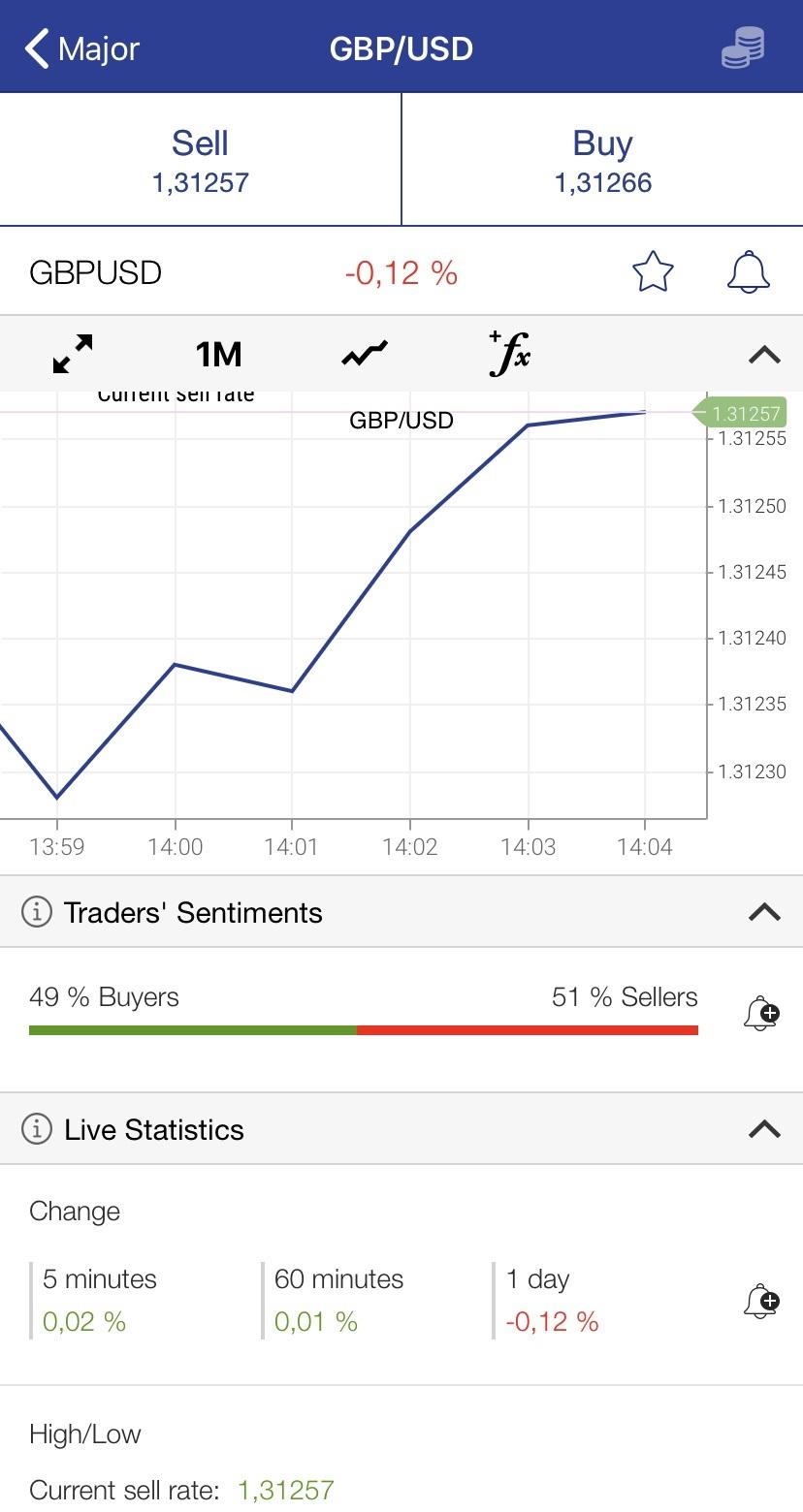

Mobile Trading

Plus500 offers three trading platforms, the mobile, desktop and web platforms. Mobile users enjoy an experience similar to that of desktop users. This includes access to over 2000 trading instruments and expanded charting possibilities, indicators and account details. The enhanced mobile trading platform also scores highly when it comes to usability. Besides the welcoming user-friendly trading interface, users also enjoy a good search function and two-step log-in. For insightful Forex CFDs and CFDs trading sessions, the Plus500 trading App allows users to set basic alerts. The security of mobile users is safeguarded using the fingerprint unlock. The Plus500 mobile App also allows seamless account deposit and withdrawals.

A Plus500 Review of the benefits of using the mobile platform:

- Opportunity to track finances and interlink personal bank accounts

- Convenience of trading on the move

- Frequent alerts on market events via email and push notifications

- Access to watch lists and syncing feature

Markets and Investment Products

The Plus500 trading commodity CFD’s features a broad range of products, which traders are allowed to buy and sell. The list includes oil, platinum, natural gas, cotton, gold, wheat and gasoline. As expressed earlier, Plus500 receives compensation via a well-articulated Bid/Ask spread. The commodities CFD’s comes with enticing 1:20 leverage with trades start from as low as $100. The trading account can be funded via credit card, Skrill and bank account. The commodities CFD market is generally driven by factors like currency movements, government policies, economic growth and breaking geopolitical occurrences. To ensure profitable commodities trading, users need to be updated with the different account management strategies and profit and loss control. The intuitive resources include:

- Free email and push notifications on various marketing events

- Stop limit, trailing stop and stop loss

- Guaranteed stop

- Price movement alert, change and traders sentiments

When it comes to trading shares, Plus500 has done the heavy task of bringing popular international markets to the reach of international traders. The group gives users access to over 2000 financial instruments; 24/7 customer support and free real-time quotes. Access to advanced trading tools has given traders the opportunity to control risks and profits. With a share leverage of 1:30, an investment of $200 can potentially earn up to $60,000. For keen investors, the popular tech share listings include names like Alphabet, Apple and Facebook. The foreign exchange market or forex is reputed to be the largest financial market anywhere in the world.

Plus500 is dedicated to providing an enhanced trading environment thanks to 24/7 CFD trading on select forex pairs. The platform supports three popular markets: the futures market and forward forex market. Most of the pairs involve USD against other major currencies. Traders can always make use of the intuitive forex tools to safeguard profits and limit losses. The forex market is generally influenced by reports on interest rate changes, economic data, international trade balance and economic growth. The interest rates are controlled by central banks. On the overall, the broker is in active competition with such entities as City Index, Trading212 and XTB online trading.

Plus500 offers numerous marketing and investment opportunities via it’s +500Affliliates program. The entities looking to join or be part of the program can get in touch with a customer representative by submitting particulars like name, email address and a brief message. The parties eligible to join include private individuals above age 18 and corporate entities. The payment terms stipulated in the affiliate program have made it one of the most transparent and profitable on the web. With over 100,000 affiliates, Plus500 prides in being the largest financial affiliate in Europe. The program won the prestigious iGB Affiliate Awards in 2015, 2016 and 2018. To grow its brand, internationally Plus500 also partners with firms like Finannzen.net, Mercati24, Chicago Bulls and BSC Young Boys.

Customer Support

To serve customers from around the world better, Plus500 encourages users to send a request form with the queries they want resolved. The broker offers quick and reliable, 24/7 customer support and will respond via email using its official handles. The around the clock support is available via email, whatsapp and live chat service. Plus500 also maintains an active presence on social media sites like Instagram, Facebook and Twitter. Customers with complaints can also communicate with the Ombudsman office that is based in the UK. The website to reach the UK Financial Ombudsman offices is www.fos.org.uk.

Education

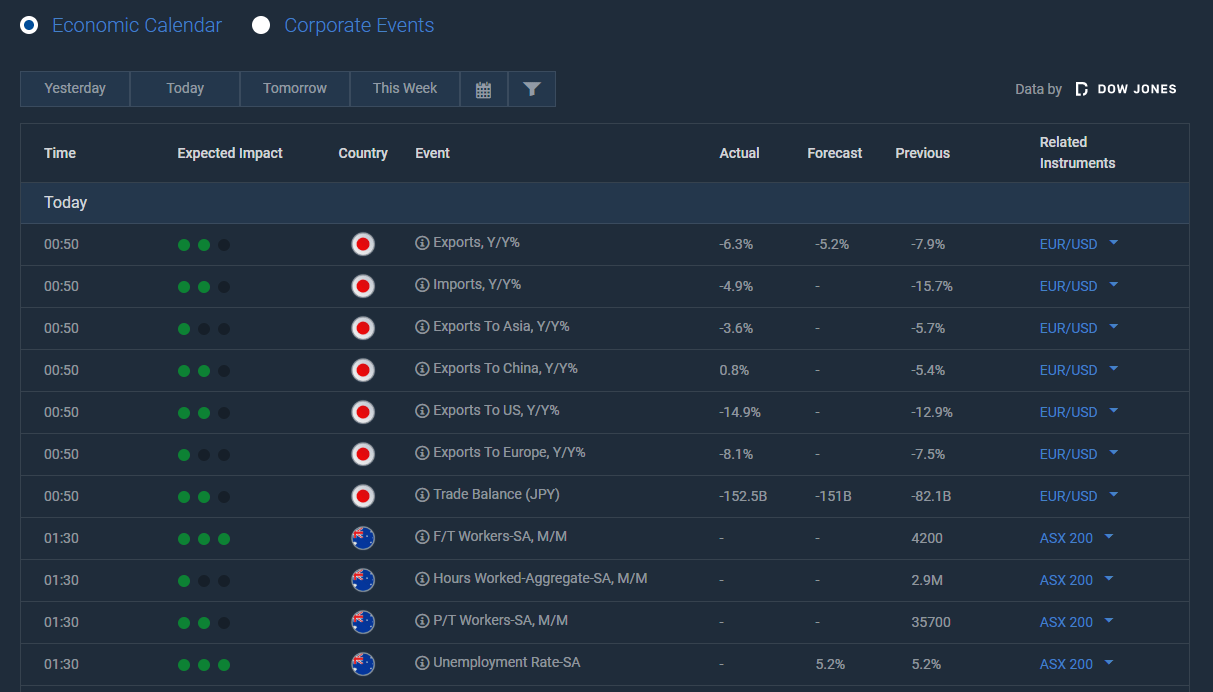

The learning resources at Plus500 are offered under various sections, including the trader’s guide. There are a few “how to videos” discussing online trading and other hot topics. For first-hand user experience and insight, the broker offers a demo account. The broker also has an economic calendar, which inclues events that will likeley affect currencies. The latter is powered by Dow Jones. To assess user’s responses, Plus500 has included trader sentiment data. In spite of the efforts to sensitize traders and the public, the educational resources are largely limited.

The Frequently Asked Questions (FAQ) section is fairly comprehensive and covers critical questions and topics. The section is integrated with a powerful search engine for extended visibility. Users can visit the FAQ section to learn more about:

- The account verification process

- Deposits and withdrawal methods

- Broker fees and charges

- Financial instruments

- Industry regulators

- Trading methods and restrictions

- Company policy

Pros and Cons

- Traders have access to over 2000 trading instruments

- Easy-to-use trading platform

- Multiple regulations from trusted entities like MAS, FCA, CySEC and ASIC

- Zero trading commission and tight spreads

- Low trading fees

- No withdrawal fees

- Access to advance risk management tools

- Extended customer service support

- London Stock Exchange (LSE) listing

- Dedicated multilingual customer service support

- Opportunity to train using demo account

- A few research tools

- Limited product portfolio

- Mid-range educational resources

- Inactivity fee

- Lack of in-person phone support

- No discounts for VIP clients or active traders

- No special tools like automated trading via algorithms or dedicated advisors

- The grounds to pair WebTrader with other trading platforms is limited

Plus500 Futures

Plus500 entered the US market back in 2021 with the acquisition of Cunningham Commodities and one idea in mind – to make future trading more understandable for the retail client. Fully regulated by the CFTC, the company launched their platform the following year, and it keeps improving, hoping to reach new heights on the market. Users have the choice between a great range of instruments, including future contracts on Cryptocurrencies, Forex, Agriculture, Metals, Energy, Interest rates and Equity indices (so far, the platform is available to US citizens only).

Futures are financial contracts in which two parties, usually a buyer and seller, agree to buy or sell (transact) a financial asset like a Commodity, Index, etc. at a fixed price and time in the future. In other words, two parties enter into an agreement with one of them buying a Future’s underlying asset, and the other selling it later at a specific price and time in the future, regardless of the prevailing market price at the time.

For anyone that’s new to the world of future contracts, the Plus500Futures platform offers an unlimited demo account, along with a Futures Academy available on their site with articles and videos to help users get into the market. All clients also have access to customer support 24/7 via email in case they have any questions. More experienced traders can dive right into it with a real account that requires only $100 to be opened. The platform offers Micro and E-Mini contracts with great margins and low commissions, so even the minimum deposited amount possible can get a good exposure to trade with various contracts.

The design of the platform is straight-forward and boasts some great features like analysis tools, lots of charts and indicators to help traders with their trading strategies. The web version and the mobile app work identical, making the transition between the two as smooth as possible. Clients can enjoy trading on the go, without having to compromise on the functionality. The mobile app is available both on the App Store and Play Store with great ratings and reviews.

The Bottom Line

Since its establishment over 10 years ago, Plus500 has built a solid reputation for offering CFD trading to a global audience. Inexperienced traders will find the broker both straightforward and easy to use. The platform also scores highly on the issue of trust. The online trading platform is registered and regulated by renowned, top-tier financial entities like the Cyprus Securities and Exchange Commission (CySEC), FSCA South Africa and the Financial Conduct Authority (FCA). The listing of Plus500 stocks on LSE is also significant in terms of public trust. Companies listed on the stock market are legally required to provide financial reports to stakeholders and the general public.

The other features that make Plus500 an outstanding trading platform include: negative balance protection (negative balance protection is a regulatory requirement with which Plus500 complies), competitive spreads and simple and intuitive platform. Although Plus500 stands tall as a trusted brand with a global outlook, its research and education resources are limited going by this Plus500 review and prevailing industry sentiments. As part of its commitment to best industry practices, Plus500 strongly believes in transparency and the provision of personalized service as evidenced in its quick and reliable 24/7 online support. The support is available via email, Live Chat and WhatsApp. Before registering to trade at Plus500, traders need to know the underlying benefits and risks of CFD trading.

User Reviews

They are bunch of looters stealing money and running spoof websites to cheat people. They are nasty daytime robbers. Once you put money, they automatically move it. Please don’t don’t deal with plus500. The team at has been helpful so far with getting refunds for victims.

Nothing more to add, Plus500 is a really solid broker with low fees and a great trading platform, especially for beginners like me. I had no problems using it at all!

Started trading a few weeks ago since a friend of mine did recommend Plus500 to me – transparent broker with fair fees, a solid trading platform and a high amount of tradeable assets.

Plus500 is one of the best brokers for beginners – transparent, unlimited demo account for testing strategies and getting familiar with their platform and a good customer support who’s available 24/7.

Fees are a little bit too high!

Very satisfied since 4 years. I’m trading cfds among others at IG and Plus500. Most people who write negative reviews need to stop blaming the broker and start learning how to trade.

Account opening was very fast and smooth, without any problems. Trading on their platform is intuitive, works well and I had no problems with the platform itself.

Here are some points which I personally like best:

– low spreads

– good trading platform

– quality support (they do take their time, but they’re always looking to help you when you’ve got a problem)

– wide range of tradable cfds

Very happy with their range of tradeable assets. All trades were executed correctly and on time. Payment works fine with paypal.

Happy with the conditions, platforms, assets

Not happy with how bad the customer support is. If you’re this big in the broker world you need to have at least a decent support.