Plus500 has low fees, both trading fees and non-trading fees. Unlike many other, non reputable brokers, Plus500 has no hidden fees. When trading with this broker, you can expect 0 fees for:

- Deposits

- Live share CFD prices

- Opening / closing trades

- Rolling your position

- Real-time forex quotes

- Dynamic charts & graphs

Let us take a more detailed look into non-trading fees and trading fees.

Contents

Trading Fees explained

Online brokerages generally make money by charging you different fees for various rates. Usually, there are 2 types of fees:

- Non-trading fees. These fees occur when you do various different operations in your account, i.e. deposting/withdrawing money to/from your account, or not trading for a certain time.

- Trading fees. You pay when you actually trade, i.e. buying stocks or options. In this category, you have to distinguish between 3 different fees that the broker charges you:

- Commission (a commission is based on the volume traded or fixed)

- Spread (the difference between the buy price and the sell price)

- Financing Rate (which is charged when you hold leveraged positions for longer than a day)

Additional fees can be charged. For more information visit: https://www.plus500.com/en/FAQ/FeesCharges

Non-Trading Fees

When looking at the non-trading fees (fees that you have to pay which are not related to buying and selling assets), you can see that the main charge here is the inactivity fee. The inactivity fee amounts 10$ per month after 3 months of inactivity. Inactivity means that you don’t log in to your account. So if you plan to choose to trade with this broker, you need to be strategic about your trades in order to avoid getting charged the inactivity fee. If you are a buy and hold investor, this broker may be less ideal for you.

Other than that, there are no withdrawal fees or deposit fees. The broker does not charge any account fee at all.

| Description | Plus500 |

|---|---|

| Account fee | No |

| Deposit fee | $0 |

| Withdrawal fee | $0 |

| Inactivity fee | Yes (10$ per month after 3 months of inactivity) |

Plus500 Deposit Fee

Deposit fees occur when you send money from your bank account to your trading account. Plus500 does not charge deposit fees, no matter which option you choose to send money from.

| Deposit Method | Available |

|---|---|

| VISA / Mastercard |  |

| Credit/Debit Cards |  |

| Paypal |  |

| Bank Transfer |  |

| Skrill |  |

| Deposit fee | $0 |

Plus500 Withdrawal Fee

Withdrawal fees occur when you withdraw money from your trading account and send it to your bank account. Usually, brokers does charge a withdrawal fee. In this case, Plus500 does not charge withdrawal fees at all.

| Withdrawal Method | Available |

|---|---|

| VISA / Mastercard |  |

| Credit/Debit Cards |  |

| Paypal |  |

| Bank Transfer |  |

| Skrill |  |

| Withdrawal fee | $0 |

Trading Fees

Plus500 trading fees are very low. So it’s clear to say that this broker is suitable for you if you trade more often. W

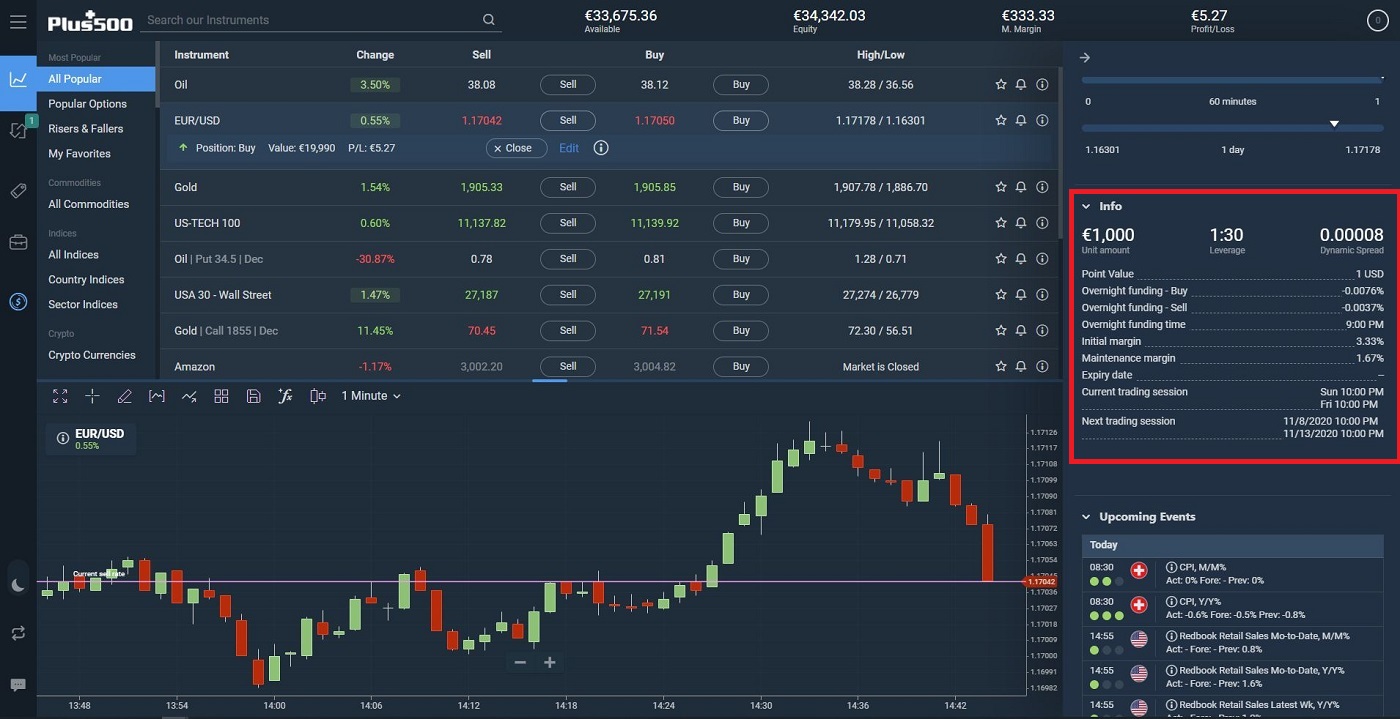

Financing rates

The only downside when it comes to fees at Plus500 are the financing rates. These rates are very high and will be charged when you trade on margin or hold your positions for a longer period.

| Financing rates (Overnight Fees) | Plus500 |

|---|---|

| EURUSD financing rate | variable |

| EURGBP financing rate | variable |

| Amazon CFD financing rate | variable |

| Royal Dutch Shell | variable |