Forex trading is easy to start as it only requires $10 to start trading on libertex with high leverage.

| GBP/USD Spread | n/a |

| EUR/GBP Spread | n/a |

| EUR/USD Spread | n/a |

| Assets | 49+ |

You can trade many different cryptocurrencies with 50% reduced commission.

| Spread | 50% reduced commission |

| Leverage | No |

| Cryptocurrencies | <200 |

Trade is the exchange of services and commodities to make a profit. As the world makes steps toward digitalizing the markets, online trade is proving to be a space that can harness potential on investment and create rewarding deals. Online trading has shifted the goalpost from traditional methods of buying stock or securities. Online trading refers to the buying and selling of stock and securities through online platforms or brokers.

There are millions of dollars involved in everyday online trade, and it is important to research before joining the venture. One of the brokers in online trade is the libertex forum that seeks to educate the traders and make a profit from the transactions.

Contents

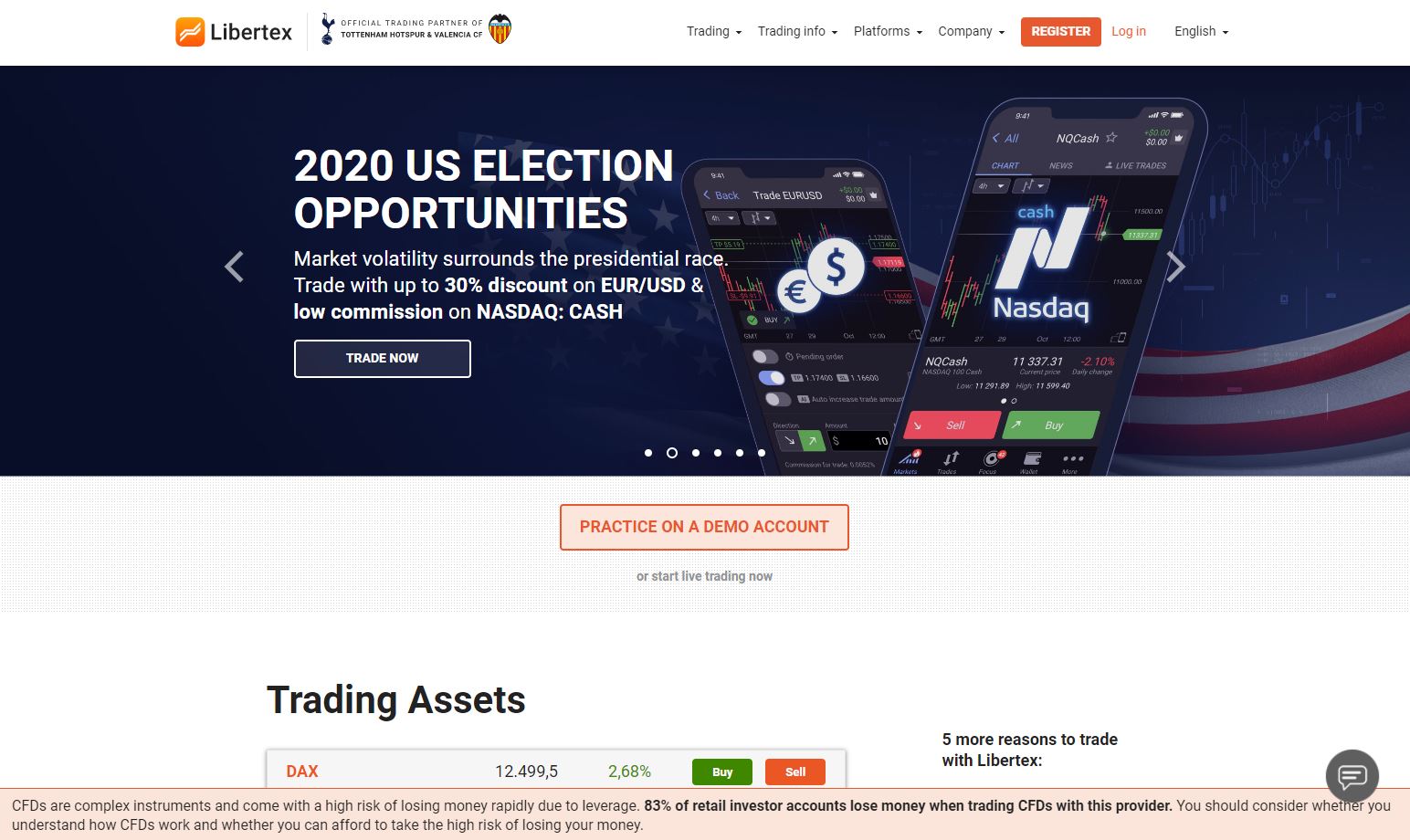

Account Opening

In Libertex, there are two main types of accounts that a user can open to interact or do the actual trading with the platforms. The retail and the professional account. However, Libertex provides a demo account for both accounts. A demo account is a simulation of the real money trading environment with real instruments and actual market conditions. An investor can investigate and practice using the platform or test new or different trade strategies without risking real capital.

To open a demo account, click on the practice on a demo account and sign up using Facebook details or email account. You must input your email address, password, first name, last name, country, city, mobile number, and consent that you are 18 years old. Once your information has been processed and verified, $ 50,000 in virtual money is loaded into your account for practice. The gains made from trading on the demo account are also virtual, and hence they cannot be withdrawn into your bank account.

The first type of account is the retail account, also called the standard account. This account allows users to trade with real money and withdraw from successful trade into their real bank accounts. To use the standard account, the investors log into the platform using their user name and password, then click on “Deposit to your account.” The platform requires a minimum deposit of ten currency units either in euros, American dollar, the sterling pound, or any other currency base accepted by the broker.

Deposit methods are displayed, and investors can select their preferred mode of payment and notified once they had completed the transaction. The user is then able to trade on the over 200 assets across multiple platforms.

The second type of account at Libertex is the professional account. This account differs from the former one due to leverage. While the standard account has a maximum leverage of 1:30 for European citizens and 1:500 for non-European customers, the professional account has a maximum leverage of 1:600. Professional clients are not subject to the new European limitations on leverage and are not covered by the Investor Compensation Fund (ICF).

The criteria to qualify for the professional account is to meet at least two of the following:

- Notable trading activity in the past 12 months with a minimum of 10 trades of considerable amounts in every three months.

- Apposite work experience in the finance sector with not less than 1 year in a professional post.

- The size of your financial investments must be surplus £500,000.

Demo Account

Commissions and Fees

A trader in libertex trading on classic financial instruments is exposed to two kinds of commissions and fees. The first is the transaction fee, which is taken when a trade is opened. The other is the rollover fee charged when a trading day comes to an end.

The rollover fee is taken as an interest regardless of whether the market direction is positive or negative. For CFD instruments rolled over from Friday to Monday, the rollover interest fee is triple, and the Fx pairs position rolled over from Wednesday to Thursday. Different trading instruments attract different commissions and fees.

Deposits are always free, withdrawals depend on the method you want to withdrawal to:

- Sepa and bank wire take three to five days to process the transaction fee of 0.5% on £10.

- Neteller charges a fee of 1%, and the funds are available in 24hours.

- Credit and debit take one to five days to make funds available at a fee of £1.

- Skrill is the cheapest method of withdrawal, as it is free to withdraw and get the funds after 24 hours.

| Description | Libertex |

|---|---|

| Account fee | No |

| Deposit fee | $0 |

| Withdrawal fee | Yes |

| Inactivity fee | No |

Deposit and Withdrawal

Deposits in libertex can be made through bank wire, credit and debit cards, Ideal, NEO surf, Sofort, Teleingreso, trustly, skrill, sepa, and Giropay. The minimum deposit that a trader is allowed to make is £100, and there are no charges on deposits. Libertex allows you to you manage and a preferred method of withdrawing funds.

| Deposit Method | Available |

|---|---|

| VISA / Mastercard |  |

| Credit/Debit Cards |  |

| Neteller |  |

| Bank Transfer |  |

| Skrill |  |

| Giropay |  |

| Trustly |  |

| P24 |  |

| iDEAL |  |

| Multibanco |  |

| Rapid Transfer |  |

| Teleingreso |  |

Libertex has different ways of withdrawing funds, and each method has a specified fee and time before the funds get to the trader.

| Withdrawal Method | Available |

|---|---|

| VISA / Mastercard |  |

| Credit/Debit Cards |  |

| Neteller |  |

| Bank Transfer |  |

| Skrill |  |

Regulation and Reputation

Libertex is operated by an indication investment limited and is regulated by Cyprus Securities and Exchange Commission (CySEC). It operates on number 164/ 12.

It prides itself on being a multinational with over 2.2 million customers and operating in 110 countries worldwide. It is a component of the Forex club group and operates on indication investment limited or forex club international limited under the number 1529 and 2014 depending on the part of the world the trader is located.

Libertex is a premium partner and sponsor of the Spanish football club Valencia. It also sponsors Tottenham Hotspur, a London based football club.

Trading Platforms

| Platform | Available |

|---|---|

| Web | Yes |

| Desktop | Yes |

| Mobile | Yes |

Libertex uses three main types of trading platforms. The platforms are Libertex in-house trading platform, Metatrader4, and the latest to be incorporated, Metatrader 5.

Metatrading Platforms (Metatrade 4 and Metatrade 5)

Metatrader is a light software that links different brokers and allows traders to get the best prices and trade in them. Libertex uses both Metatrader4 (Mt4) and Metatrader5 (Mt5). However, European Union residents can only enjoy the liberties in-house, and Metatrader4 as Metatrader5 is not allowed in these countries. Libertex provides the standard version of the Metatrader5 without additional program utilities.

Mt4 and Mt5 are platforms for more experienced traders who are willing to maximize their profits. These two meta trading platforms have many similarities. They have algorithmic trading in which robots can control analytics and trading. Traders can set the maximum loss that can be incurred, limiting the capital exposer to losses when the markets move in an undesired direction.

Traders can protect their gains by allowing trade to continue as long as the price continues to move in the desired direction. They only close the trade after a specified percentage or number of pips is achieved.

Both provide traders with current financial news and alerts. As a trader, you can take advantage of the opportunities present or use it to make better financial decisions. The platforms provide verified analytical tools through plugins. Mt4 and Mt5 can easily be downloaded for desktop or mobile use.

In Libertex, traders get over forty-five currencies and one hundred effective trading tools through Mt4 and Mt5. Client orders are executed without dealers arbitration, and traders benefit from the inbuilt trading signals.

The Mt4 is more popular, while Mt 5 has more features. The additional features in Mt5 include an economic calendar, the depth of the market, which allows clients to see where bids and offers are priced. Mt5 has twenty-one timeframes in the interactive charts, while Mt4 has nine only.

Mt5 has 44 geographical objects, while Mt4 has 32. Mt5 allows both hedging and netting, while Mt4 only allows hedging.

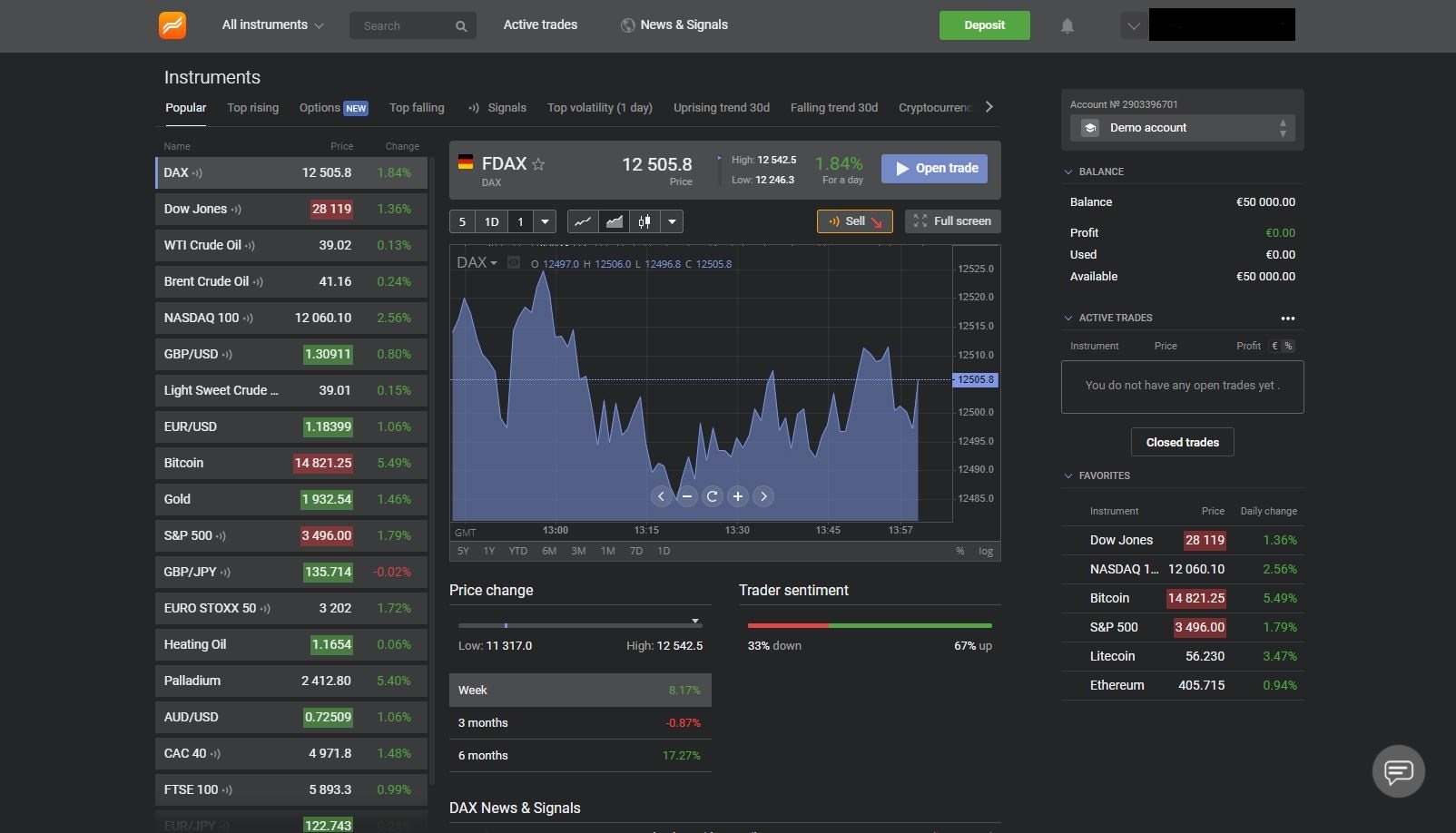

Web Trading Platform

The Libertex in-house platform is designed to provide new brokers with all the information they require to become expert traders in financial assets. Most of the traders attracted to this platform are interested in swift managing their capital and making huge profits. Traders can have a personalized user experience due to customizing and tailoring the interface to meet their tastes and preference.

Libertex in-house trading platform is desktop-based, meaning that you can install the application into your personal computer. It is also website-based, implying that you can use the platform on your browser and mobile-based, meaning you can download the application on your mobile device.

User Experience

Libertex in-house platform is user friendly and allows the traders to easily switch between the demo account and the live account with fast execution time. This platform helps users to gauge their and improve their efficiency.

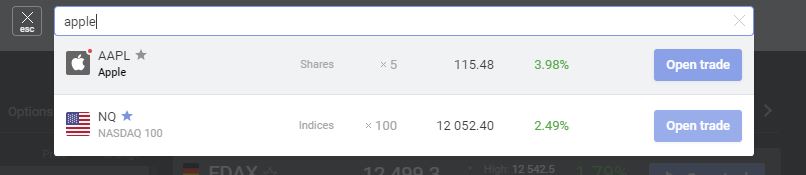

Search Function

The trading platform offers a well-built search function, where you can search for any product you’d like to invest. As you can see down below, we had no troubles using it.

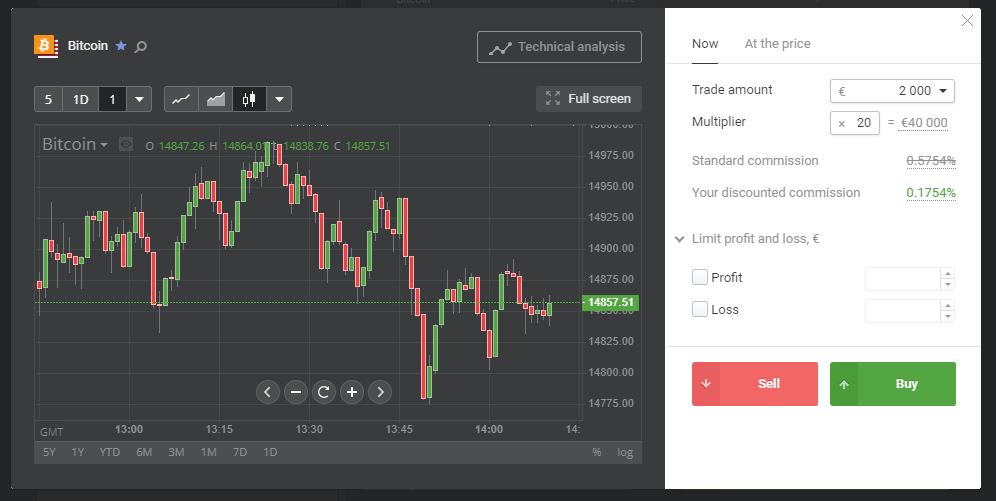

Orders

You have a number of different order types from which you can choose. Making an order is simple and done in a few minutes. You can choose from limit profit/limit loss and also can change the multiplier.

Charting

The platform offers a great charting tool – you can customize the whole platform. There are lots of drawing tools, indicators, different chart types.

Desktop Trading Platform

Libertex offers a desktop trading platform (MetaTrader 4 or MetaTrader 5).

Mobile Trading

Libertex allows traders to access the markets via mobile devices. It is available for both iPhone and Android software, thus not limiting. To access the markets, you first download the application, open the app, and select a preferred account for the deposit.

Click on the fund account and select a payment method and the amount you wish to deposit, and you will get a statement confirming the transaction made.

Markets and Investment Products

Libertex allows traders to choose different markets. Depending on your goal and trading technique, you can select an investment product from the hot assets, cryptocurrencies, stocks, forex, metal indices, agriculture, oil, and gas to EFTs.

Hot Assets

Hot assets or trading assets refer to a collection of securities such as bonds, stocks, commodities, or currencies held by a firm for resale for a profit. Traders choose Some of the most popular assets on libertex due to volatility and profit potential. They include Doe Jones, Wall, and Brent crude oil.

Cryptocurrency

Libertex allows the trade of various cryptocurrencies on their platforms such as Bitcoins, Lite coins Bitcash, Ethereum, and over 200 other cryptocurrencies. Cryptocurrency is an online-based medium of exchange for goods and services. The trade involves buying cryptocurrency from another with the hope that the currency will increase in value.

Traders can either trade in the short-term or long-term. In the short term, the trader buys the currency when the price will go down in the hope that its price will increase then sell it for a profit when the prices begin to rise. Cryptocurrency offers great opportunities to obtain huge profit gains since the prices can almost double in a single night. The long-term entails buying the cryptocurrency and then waiting for a long time to sell when the prices are high.

Forex

Forex is the trade of currencies. Traders usually buy and sell different currencies taking advantage of the derivative to make profits. Forex trading aims to purchase a currency when undervalued and sell it when the value rises with the native currency.

Forex trading is so popular because of its liquidity, trader familiarity with select currencies. This provides great strategies and a swift response whenever there is a change in the market. Forex trading is easy to start as it only requires $10 to start trading on libertex with high leverage.

Some of the major currencies traded on libertex include sterling pound, American dollar, Japanese yen, euro, Australian and Canadian dollars, and the Swiss franc. With an average of $5.1 trillion in daily trade, forex is the largest market globally, and libertex provides a great platform to tap into this market.

Stocks

Stock trading involves the buying and selling shares of a company. Stock traders have a goal to buy the stock when they are selling low and sell them later at a higher price. Libertex allows traders in its platform to take advantage of the price movements on individual price performance due to revenue balance sheet forecasting and anticipated moves.

Libertex offers an all in one platform where traders can select to trade in different companies, industries, luxury, automobile, healthcare, sports, among other companies. Some of the major stocks in libertex include Google Inc, Microsoft Corp, Twitter Inc, eBay Inc and, Facebook.

Agriculture

Agricultural products are considered a strong trade instrument by beginners and professional traders. The available agricultural assets on libertex are soybean, sugar, corn, wheat, coffee, and cocoa. Wheat is a major food export source by many countries, with Russia, the USA, Canada, France, and Australia taking the lion share in dollar value in 2019.

Soybeans make a good investment due to inflation, the weak US dollar hedge, investment instrument diversification, and anticipation of its growing demand. However, soybean and corn hang on the seasons, and contract liquidity is greatly affected by the delivery time.

The contact liquidity slowly increases with time as the expiry date for the crops approach. Sometimes, with a few days to the expiry, the liquidity of the crops drop considerably low. Cocoa and sugar have great versatility due to the number of products they are used in, making them a treasure worth trading as their demand is always increasing.

With a huge market and volatile aspect, the commodities offer an opportunity for profit with rising and fall of price.

Indices

An Index is a financial derivative calculated as the weighted average of share prices of top-performing companies listed on the exchange. They serve to evaluate the performance of a portfolio’s return on investment. With libertex, it is possible to trade on major stock indices that play a vital role in the globe’s financial scope.

Indices are a good signal of the performance of the stock market in a particular country. Some world popular indices on libertex include:

- FTSE 100 that tracks the top 100 stocks at the London stock exchange.

- Hang Seng Index tracks the performance of the 50 largest companies by capitalization on the Hong Kong market.

- S&P 500 is the basket of all the largest 500 stocks in the US, representing 80% of the total market capitalization, thus indicating the US economy’s performance.

- Nasdaq 100 shows the shares of the 100 largest American and international companies by market capitalization.

- China A50 baskets the largest 50 Chinese companies in the stock market.

Metals

Precious metals that can be traded at libertex are silver, palladium, gold, copper, and platinum. These metals are not valuable because of their sheen and gloss but also their industrial use. Platinum is the third most traded metal. It is used as a platinum catalyst that helps manufacture silicone, hard disks, sensors for home safety devices, and fertilizers.

Its inert nature makes it ideal in making medical devices and jewelry since it does not tarnish. Palladium shares common characteristics with platinum. The world’s major supply comes from Russia and South Africa. With the production of high-powered gasoline vehicles, the demand for palladium is high.

Traders can invest in this metal by buying palladium bullion bars, coins, or collectible palladium, all of which are easy to buy, hold, sell, and trade for a portfolio’s growth. Copper is preferred in making home appliances as it is resistant to corrosion and has high price versatility. These characteristics make it a good trading commodity for investors.

Silver is the most traded metal in the world due to its volatility and industrial use. Traders can invest in silver bullions, silver futures, and silver ETFs or through mutual funds and stocks. Silver has high liquidity and can provide your portfolio with constant and diversified returns.

Gold is the most traded metal, and it is used as security to maintain its high price due to the fall in the value of The US dollar against other currencies. Gold is a good hedge over inflation as its price increases with the cost of living. The decrease in its supply has increased its prices as it gets higher demand in the jewelry industry.

For a diversified portfolio, it is vital to invest in gold. In the short term, gold prices can be volatile, and traders can capitalize on this at libertex to gain profits.

Oil and Gas

Crude oil is commonly used in energy production and manufacturing and is refined to gasoline, jet fuel, cosmetics, diesel, plastics, and fertilizers. It is classified into WTI and the Brent Blend and further classified into a light and sweet oil.

Libertex has this asst instrument from which traders can make their trade with profit prospects in mind due to the products’ volatility.

ETF Options

Libertex has a range of ETF options such as iShares MSCI Germany and iShares MSCI United Kingdom ETFs.

Customer Support

Customer support is a set of services offered to customers to help them get maximum profit from a product. Libertex has approximately 2.2 million traders. The existence of other brokers provides competition for them. A customer support system is important to maintain their customers and draw more to use their services and products.

Customer support gives both Libertex and the traders a medium to exchange comments and feedback. The traders can air out their problems, and libertex can give relevant feedback and help. The users’ comments and reviews help the company improve its customer service and products.

At Libertex, customer support is only available during weekdays from 8 am to 8 pm. One of the ways through which Libertex offers customer support is through social media networks. Companies and corporates use social media accounts to build a relationship with customers. The company communicates by putting up posts and updating information on the sites to keep conversations between them and their customers.

Libertex uses telegram, Twitter, and Facebook as their social media platforms. They have different languages from English, Spanish, Italian, Dutch, French. Greek, Russian, Polish, and German help them reach traders in different regions using their preferred language.

Libertex also gives users access to the FAQ section. This is part of self-service services that allow the traders to solve issues without necessarily asking help from the customer care attendants. Self serve knowledge base refers to a collection of information about a product. It is organized so that the customers can easily find and provide easy guidelines to follow to resolve issues.

In Libertex, the FAQ section provides information about the trading rules and operations, payment methods, and services. They also operate blogs that help traders with important information and valuable trading tips.

Emails and chats are other platforms that libertex uses to be available and useful when traders need help. Apart from providing information on their geographical location, libertex gives email and contact numbers for customers who believe in or need one on one communication with the customer care desk. They also have a chat call that allows a trader to click on a chat and make direct inquiries about an issue.

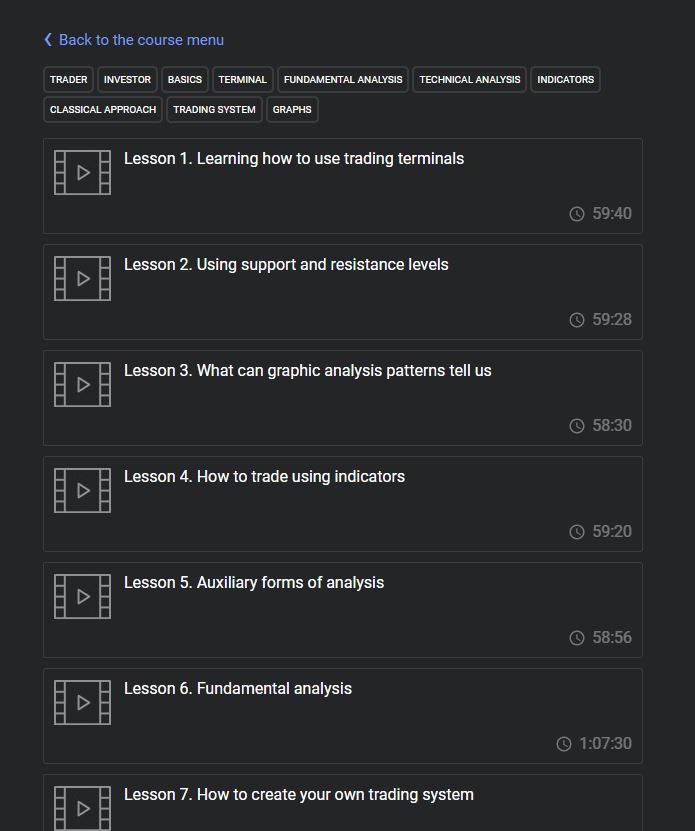

Education

Libertex is designed to assist novice traders in getting access to the information they require to become expert traders. It has a training course with articles and videos to give traders knowledge on different platform levels.

Lessons are arranged in order from the first steps. These are the most basic equipment a trader needs. Traders are then provided with tools, examples of trade, and simple strategies to help them navigate the fore markets. Next are the pro level theory, pro-level practice lessons, and guru tips, which help established traders to polish their skill and ensure that they remain at the top. They also set up webinars to educate and interact with traders.

Pros and Cons

- The demo account has no money or time limitations

- One can easily switch between the real environment and the demo account

- Has fast execution, and traders can open or close accounts on time

- It is equipped with new strategies to help a trader

- Provides training and webinars for traders

- Low commissions and no delayed withdrawals

- The interface is user friendly

- Contains a lot of technical analysis

- A trustworthy commission regulates it

- Has over 200 instruments for trading on

- Is not limited to language as it has 10 different languages of communication

- Has reliable partners, which is proof of security

- Restricted leverage for retail clients

- Unreliable customer support

The Bottom Line

Libertex has been in operation for over twenty years. It is simple to use and is regulated by a trusted regulation commission. The benefits of joining this platform outweigh its disadvantages. That is not to mean that successful trade is guaranteed because the markets in forex trading fluctuate. However, among the existing trading brokers, Libertex is a suitable platform for traders.

User Reviews

Overall very happy with my decision to choose Libertex as my broker. Lowest fees from all brokers I’ve looked at, while also beeing transparent about everything they do. Can recommend!